by Rhoda Wilson

BlackRock and Vanguard’s dystopian climate agenda is being curtailed by US States that are pushing back against the ESG tactics being implemented to control industries, force “green energy,” and monitor people’s every move, decision, and dollar spent.

On Tuesday, House Republicans launched an investigation to probe into climate groups spearheading the environmental, social, and corporate governance (“ESG”) movement. And hours after officials in the state of Texas announced a hearing, Vanguard announced it has withdrawn from the Net Zero Asset Managers initiative.Don’t Let Your Mortgage Servicer “BlackRock” You with Verint’s Scary ESG Survey

It’s no secret that BlackRock CEO, Larry Fink, has been the key driver in pushing financial institutions and companies into “changing their behaviour” and how they operate so as to comply with the grand ESG scheme. Environmental, Social, and Governance are the buzzwords making their way into every major corporation, and some states aren’t on board with this.

While this heated debate is transpiring, New York Community Bank just acquired Flagstar Bank, both whose top shareholder is BlackRock, and both of whom service millions of residential mortgages and multi-family lending for non-luxury apartments. Of course, they want to work ESG into their new control model, so they brought on scandalous Verint to provide the framed “survey” intended to manipulate people into adopting their plan. The questions on the so-called survey, aren’t questions at all. If there was ever an example of how BlackRock and other financial institutions and companies are trying to force this agenda, this is it.

On 22 November 2022, Flagstar sent out an email to all of its customers requesting they fill out a “short survey” that consisted of 23 questions about financial, environmental, social, and corporate governance issues (“ESG”). This framed survey was produced by Verint Systems, Inc., a scandalous company, whose top shareholders also consist of ESG-pushing BlackRock, in addition to Vanguard.

This is not a survey. This is a calculated indoctrination tool by Verint with the intention of feeding a stream of information to people that will compel them to feel responsible and shameful if they do not check the “very important” box, so that these banks can then utilise the data to make their ESG case and policies. They are not interested in “customer opinions.” It is about using manipulative “nudging” techniques to coerce adoption of their plan.BlackRock Under Fire

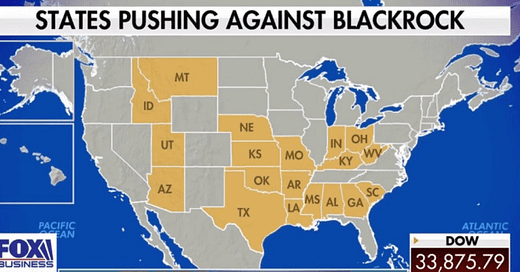

A lot of US states are not on board with the ESG tactics that are being implemented to control industries, force “green energy,” and monitor people’s every move, decision, and spending so that banks, corporations, and Big Government can make decisions for everyone and control outcomes such as how one spends their money, if they have a high enough social score to get a loan or enter a grocery store, and what industries are allowed to prosper – certainly not fossil fuels.

On Tuesday, House Republicans launched an investigation to probe into climate groups spearheading the ESG movement, to determine if they are violating antitrust laws. A letter was sent to the executives of the Steering Committee for Climate Action 100+ demanding documents pertaining to the coalition’s network of influence.

In August, Arizona Attorney General Brnovich led a coalition of 19 states who sent a letter to BlackRock warning the company about potential antitrust violations because of their push for ESG standards.

Florida has pulled $2 billion in an anti-ESG divestment, and Florida’s CFO stated that they plan to completely divest from BlackRock’s management in early 2023.

Texas just subpoenaed BlackRock for documents relating to ESG investments because they believe BlackRock is “using Texans’ money to force a narrow political agenda.”

Louisiana pulled $794 million from BlackRock funds over their ESG push.

Missouri “sold all public equities managed by BlackRock, Inc., pulling approximately $500 million in pension funds from the investment manager” over prioritising ESG initiatives over shareholder return.

Utah pulled $100 million managed by BlackRock.

West Virginia and Arkansas also pull funds from BlackRock over the ESG push.

Vanguard Drops Out of Climate Initiative as Reaction Against Woke Investing Continues

Vanguard will no longer participate in the Net Zero Asset Managers initiative as lawmakers and the broader marketplace scrutinise the company’s support of the environmental, social, and governance movement, also known as ESG.

Signatories of the Net Zero Asset Managers initiative promise to move portfolio companies closer to eliminating net carbon emissions by 2050 or sooner. Vanguard will withdraw from the initiative to “provide the clarity our investors desire about the role of index funds and about how we think about material risks, including climate-related risks,” according to a statement.

The move occurred hours after officials in the state of Texas announced a hearing over asset managers’ purported mismanagement of taxpayer dollars driven by ideological motives. Last week, multiple attorneys general filed motions with the Federal Energy Regulatory Commission seeking to prevent Vanguard from purchasing shares in publicly traded utilities out of a concern that the company’s climate efforts would raise energy prices and decrease grid reliability.

“Vanguard realised their entire business model could be at stake if they didn’t stop coordinating with other members to drive up energy costs,” Consumers’ Research Executive Director Will Hild, whose organisation also filed a motion with the agency, remarked in a statement provided to The Daily Wire. “We’ve struck a serious blow to the anti-consumer ESG agenda and we are going to keep fighting until these asset managers and banks get back to fulfilling their fiduciary duties and stop playing politics with other people’s money.”

Despite its dissociation from the Net Zero Asset Managers initiative, Vanguard affirmed that the move “will not affect our commitment to helping our investors navigate the risks that climate change can pose to their long-term returns.” The company manages $7 trillion in assets.

Signatories of the Net Zero Asset Managers initiative

The image above notes that the Net Zero Asset Managers initiative is a partner to the United Nations Framework Convention on Climate Change’s (“UNFCCC’s”) ‘Race to Zero’ campaign. This echoes language used by the global network of mayors, C40, that has a ‘Cities Race to Zero’ campaign – it’s no coincidence:

Race To Zero is a global campaign … It mobilises a coalition of leading net-zero initiatives, representing 11,309 non-State actors including 8,307 companies, 595 financial institutions, 1,136 cities, 52 states and regions, 1,125 educational institutions and 65 healthcare institutions (as of September 2022). These ‘real economy’ actors join the largest-ever alliance committed to achieving net zero carbon emissions by 2050 at the latest.

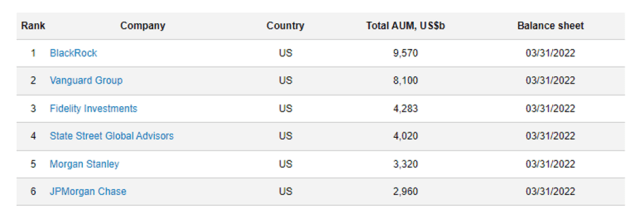

291 asset managers have signed the commitment to achieve net zero by 2050 or sooner. At the time of writing, Vanguard was not listed as a signatory. Below we’ve picked out a few of the signatories:

BlackRock. The world’s largest asset manager.

Brookfield Asset Management. Mark Carney, former governor of the Bank of England, is Brookfield’s Vice Chair and Head of Transition Investing.

Coutts & Co. Founded in 1692, it is the eighth oldest bank in the world. Coutts forms part of NatWest Group’s wealth management division.

Fidelity International. A private, international investment management firm headquartered in London.

J.P. Morgan Asset Management. As of 2022, J.P. Morgan Chase is the largest bank in the United States, the world’s largest bank by market capitalisation, and the fifth-largest bank in the world in terms of total assets.

Rothschild & Co Asset Management Europe. Beginning in the 1760s with Mayer Amschel Rothschild, Rothschild & Co is now one of the world’s largest independent financial groups.

Royal London Asset Management. A fundamental part of the Royal London Group, the UK’s largest mutual pension and investment provider.

State Street Global Advisors. The investment management division of State Street Corporation and the world’s fourth largest asset manager.

You can see the full list of signatories HERE.

*Article edited after first published: Added a screenshot of the world’s top asset managers to show that 4 of the top 6 asset managers remain as signatories and so are partners to the UN’s ‘Race to Zero’.

Featured image: BlackRock and Vanguard, The Two-Headed Thing that Ate America

The UN and WEF are coordinating with Wall Street and its hedge funds to decarbonize the planet, and its carbon-based inhabitants.

You must move your assets out of Wall Street and the big banks, and structure your tax avoidances to the absolute limit, and then some.

Fiat, taxation and investing in the very system that wants you dead are all social engineering games — those that control the fiat printing, steal your plasma via ”income” tax thievery, and rig the markets see you as nothing more than food, and as such are draining your assets (i.e. life force) as their system slow kills you:

Do NOT comply.

The collapse of nation states is well underway and perhaps irreversible with the coordinated attacks via WEF, Soros, Blackrock/Vanguard, etc. Citizens of such failing states have been recruited and indoctrinated to subvert their own heritage and freedoms from their government and corporate offices. Stopping policies is certainly a good first step but ferreting out the scoundrels and traitors must be undertaken with extreme prejudice much like our immune system would attack a cancer - else we can predict they’ll perfect a more vigorous attack. The tyranny of globalism by an arrogant cabal of self-righteous rats is a growing threat to humanity.

Good to see the pushback. Taking away their money is the only thing they understand.