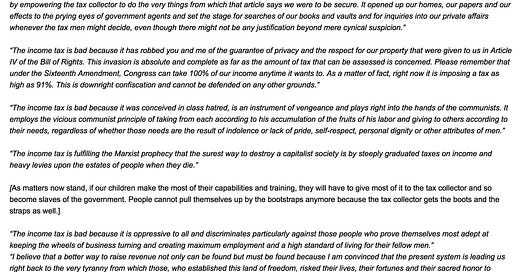

Most Americans do not know this, but in the 1950s and early 1960s the marginal tax rate in the USSA was over 90%. The facts are that the IRS is a private corporation that pays for its own postage whose only functions are to social engineer the debt-slave populace into less freedom (and more stress and fear) while backstopping the private corporation tasked with printing all of our money, manipulating interest rates (i.e. the price of money) and thus subverting any semblance of free markets; hence, subverting We the People.

The ex-IRS Commissioner could have stopped right at the start by pointing out the above, but he then goes on to make some excellent points of his own; to wit:

For further reading see Original Social Engineering Sin.

Do NOT comply.

People rightly don’t like the huge disparity in the distribution of wealth — it’s correctly diagnosed as a society-wide moral failing.

Why is the power disparity — the most politically powerful entity (which, by the way, it was expressly designed NOT to be, but that perversion is another story) taxing the least — any different in moral principle?

The federal income tax is immoral and anti-American.

taxes were indexed more heavily, with 24 divisions of income and rates, and only the very highest rate would have been borne on the top fraction of income. As an example, here is the table for 1961:

https://www.tax-brackets.org/federaltaxtable/1961