Federal Reserve CBDC & IRS A.I. 'Crackdown' Are The Twin-Pronged Attack to Strip Away All Privacy & Freedom

The debt-tax-slave screws are being increasingly tightened by the privately owned central bank, and their partner-in-crime the illegitimate IRS.

This Substack has been raising the alarm about CBDCs for quite some time now:

How Technocommunism Will Institute The CBDC: The Central Bank Game Plan In Under 3 Minutes

The entire global financial system is now essentially a technocommunist black ops money laundering crime scene. Central banks, their wall street coconspirators and the major corporations are all colluding in ushering in their hyper-centralized CBDC dystopia. This central bank “currency” will of course be inextricably tethered to the A.I. social credi…

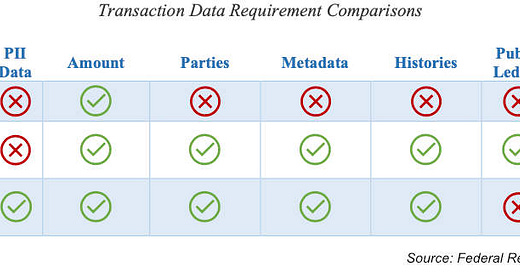

In a recently published Federal Reserve paper entitled, Data Privacy for Digital Asset Systems, this criminal central planning politburo claims that the desire for anonymity through cash transactions is misguided, and, ultimately, impossible to achieve in digital systems. Which is precisely why the Fed wants to ban cash by instituting their CBDC.

Data privacy in digital asset systems is of sustained importance to end users. However, there can be disconnect between an end user’s expectations of privacy while using a digital asset payment system and the system’s actual treatment of collected, stored, and used data.

Since even decentralized blockchains are essentially immutable ledgers, the Fed argues that all transactions are ultimately traceable. Without getting into technical blockchain mechanics, this is only partly true, and there are methods by which crypto offramps could circumnavigate these monetary technocommunist parasites, as well as strategies for remaining exclusively within DeFi ecosystems in a kind of real-world local DeFi barter network.

But the key takeaway is that the Fed is gearing up to attempt to strip away all privacy by phasing out cash while concurrently leveraging their mutable (i.e. hackable by virtue of their misguided mandates to incessantly tinker with controls in order to manipulate slave behavioral patterns via UBI, time-constrained tokens, etc.) CBDC.

Using their usual disingenuous anti money laundering (AML) and know your client (KYC) stricture excuses, the paper pretends to care about illegal activities. As such, the Fed apparatchiks are concerned that multiple small crypto payments could bypass their controls; thus, they propose spying on all transactions with “permissioned” hybrid privacy controls such that no transactions escape their prying A.I. algos.

The paper further finds that a particular combination of popular and emerging technologies may provide as-yet untested but novel benefits to maintaining strong confidentiality – and possibly end users’ expectations of privacy – while data is under audit. A nuanced approach, rather than a reliance on a singular novel PET (privacy-enhancing technologies) or dubious assurances of anonymity, may best facilitate strong confidentiality with sustainable end-user privacy protections for digital asset system users.

The Fed basically admits that they will provide a false sense of privacy and security to end users, while spying on every transaction across their hyper-centralized CBDC blockchain.

No free human being requires a central planners’ “permissioned” fiat, which is another way of saying Statist counterfeiting, or funny money.

The paper concludes by reiterating that the Fed will strip away all privacy under the guise of their “thoughtful” hybrid approach policy; in other words, their CBDC will directly port into the X Everything App social credit score nightmare:

A robust end-user data privacy strategy for a digital asset payment system starts with a thoughtful approach to technical aspects of privacy during the design phase. Anonymity, confidentiality, and full disclosure make up the spectrum of privacy, with each aspect facilitated by different design choices and confidentiality being a worthy goal system wide. A privacy strategy developed through a hybrid approach including privacy-by-design and privacy-by-policy could provide a holistic view of how, when, and where PETs and privacy tools should be employed. Specific combinations of privacy-enhancing technologies, such as fully homomorphic encryption, zero knowledge proofs, and secure multi-party computation, could provide a nuanced and novel approach to data privacy coverage across multiple tiers and use cases within a digital asset’s ecosystem. Additional system technical requirements, such as throughput, or policy requirements, such as auditing compliance, may also impact a privacy strategy’s needs and the resulting mix of privacy enhancing technologies employed throughout a digital asset’s system.

In this Great Reset dystopia, privacy will only be afforded to government, corporations, and their central banksters. This is precisely the reality inversion of the government and banking relationship with their constituents and clients; that is, We the People are the ones that by law must have total privacy, not the government and their coconspirators. The government and the Fed vis-à-vis the totally supplanted Coinage Act by law work for We the People, and as such must be totally transparent, which they are clearly not.

And the other most dangerous threat to privacy and security comes courtesy of the fraudulent IRS, which operates strictly under color of law in such a manner that its mere existence is a total subversion of the 4th Amendment of the Bill of Rights.

Readers of this Substack appreciate that the IRS functions as a social engineering agency that backstops the Fed by stripping away wealth in order to induce a greater propensity to borrow from the very bankster owners of the Fed. Because the Fed can conjure quite literally infinite fiat out of thin air, especially during “emergencies” like “pandemics,” there is no rational explanation for the stealing of the fruits of We the People’s labors, if it were not simply a pernicious scheme wrapped up in clever lies that the populace mindlessly accepts as truths.

Which brings us to the IRS’s latest power grab designed to further impoverish the working class, while inducing the maximum amount of fear through panopticon-like A.I. perma-surveillance; in a Sept. 8 statement, IRS Commissioner Danny Werfel stated the following:

There is a sea change taking place at the IRS in every aspect of our operations.

The changes will be driven with the help of improved technology as well as Artificial Intelligence that will help IRS compliance teams better detect tax cheating, identify emerging compliance threats and improve case selection tools to avoid burdening taxpayers with needless 'no-change' audits.

As we well know, the “Biden” administration has been pumping billions into the weaponized IRS to primarily harass the working poor and middle class, despite the blatant lies that the tax agency claims it would only go after taxpayers earning over $1 million.

The IRS has zero legal right to “burden” any non-resident aliens of the foreign nation of Washington, D.C.; to wit:

REPOST: Memorandum of Law: The Legality Of Income Taxation In The "50 States" Of The Union

“Nemo agit in seipsum.” No man acts against himself.

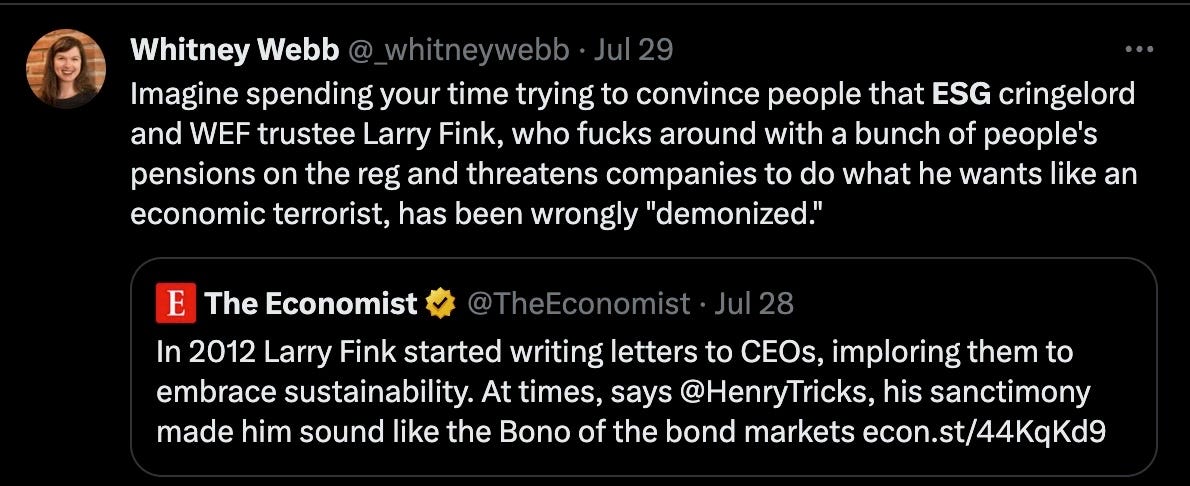

Thankfully, 50 US lawmakers have recently reintroduced the ‘CBDC Anti-Surveillance State Act’ to protect ‘the American Way of Life’ by attempting to stop the Fed dead in its tracks:

Of course, as per the above, Americans have no privacy when it comes to the scam that is the IRS. But at least Tom Emmer frames the CBDC correctly as a technocommunist oppression tool:

If only Tom Emmer would appreciate the true function of the IRS, and break free from his Statist brainwashing spells, then he could commence to rightfully and constitutionally end both the IRS and the Fed.

In the meantime, the Fed’s A.I. driven CBDC along with the IRS’s A.I. driven theft and harassment program are busily being further developed in the shadowy recesses of the 4th Branch of Government; namely, the Intelligence Industrial Complex whose main objective is to fully control the minds, bodies and finances of every last American.

Do NOT comply.

I just learned a fun fact which I actually fact checked and it’s 100% true: The etymology of the word ‘reset’ was from Scottish law and it means ‘receiver of stolen goods’. How apropos, no?!

There are so many, and ever increasing in numbers, non-democratic, un-constitutional, anti-citizen, 1984 type actions and efforts by our professional politicians in DC and their un-constitutional delegated federal creations that the question is when, not if, enough is enough, and our federal government is finally overthrown by the people it no longer represents.

Not desirable, for always results in a period of chaos. But, otherwise, what’s it going to take? Simply changing from one party to the other isn’t going to do it. Our elected do not read the bills they sign! Their time is too valuable to bother knowing what the Hell they are signing. They sign as instructed by their staffs. These staffs take direction from lobbyists, not all of whom are corporate, but also agency, representing those whose interests will profit. It’s a non-democratic mess.