Kamala Harris's top economic adviser is a socialist with a longtime passion for seizing & redistributing Americans' hard-earned wealth

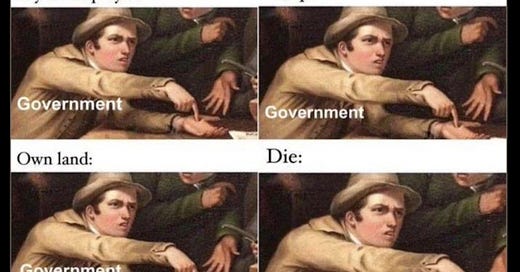

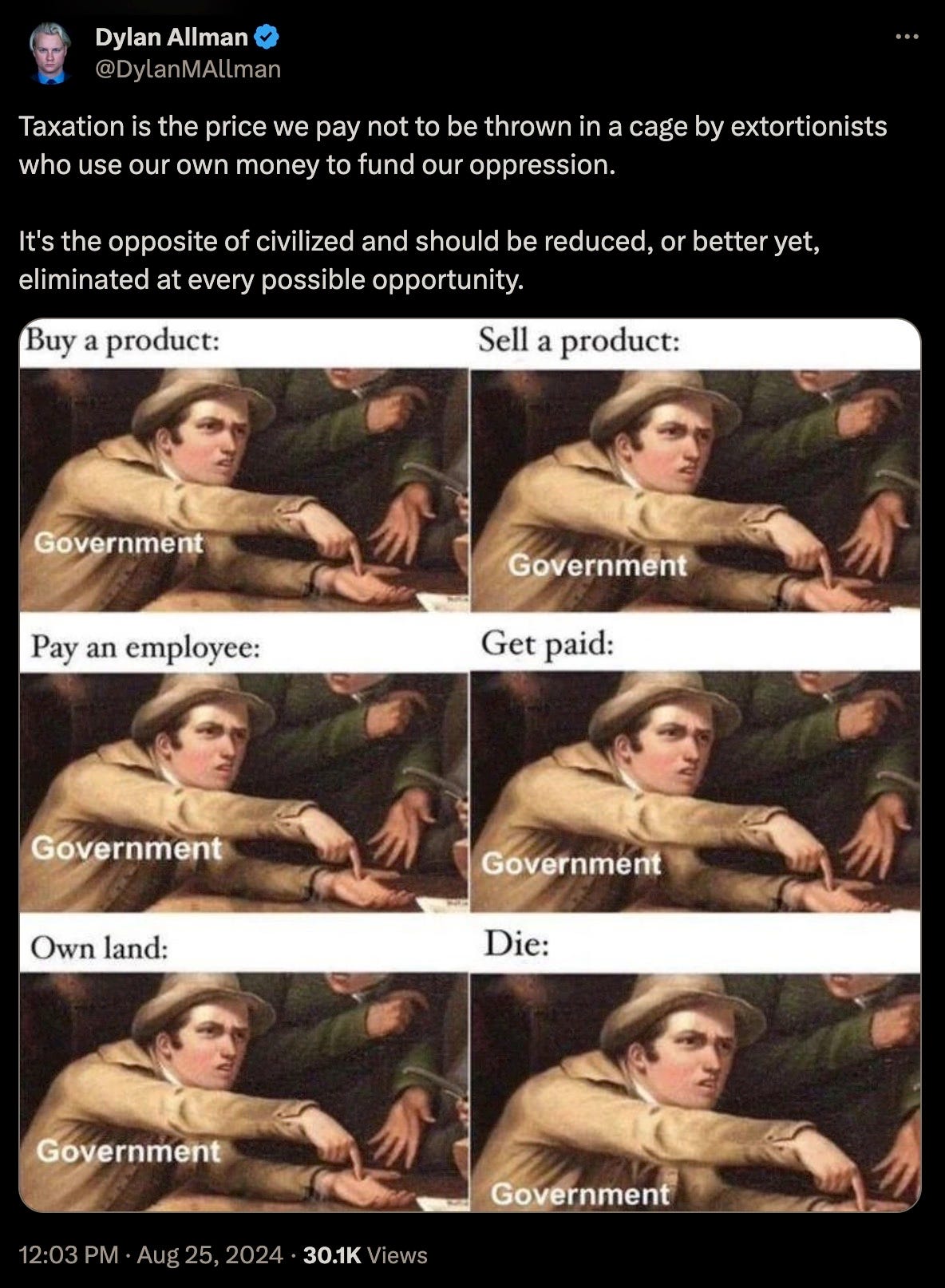

Taxation is theft.

Taxation is social engineering.

Original Social Engineering Sin

“...the socio-psychological foundations of socialism is identical to that of the foundations of a state, if there were no institution enforcing socialistic ideas of property, there would be no room for a state, as a state is nothing else than an institution built on taxation and unsolicited, noncontractual interference with the use that private people c…

Taxation is unconstitutional color of law.

Memorandum of Law: The Legality Of Income Taxation In The "50 States" Of The Union

Following his resignation, T. Coleman Andrews, who served as IRS Commissioner for nearly 3 years during the early 1950s, made the following statement:

Taxation will be further weaponized against We the People by the imbecilic hooker puppet Kamala Harris, her mendacious sociopathic running mate Tim Walz, and their useful idiot Ivory Tower grifter economic advisor Bharat Ramamurti.

What this Marxist presidential ticket is currently proposing is to merely rob the most affluent, and promises not to punish anyone else with these egregious policies, but students of Statist theft know better exactly how such things always end; to wit:

Taxation is Marxism, and Marxism aims to eradicate all freedoms; as such, if Kamala & Co. are installed off another stolen election, then these radical tax proposals that her handlers tasked her with will certainly be levied on every single productive American. (How else to pay for their Cloward-Piven hoards of illegal invaders, “climate change” destruction, rapidly metastasizing Federal work force of apparatchiks, etc & etc?)

It is of little wonder then that “Harris’s” top economic advisor has achieved far less than zero in the private sector, which is precisely why he has been chosen to help finish off the job of destroying American from within from the foreign nation of Washington, D.C.

These Marxist parasites must never be allowed to ever steal power again, or America may never recover from this continuation of their wholly illegitimate and ruinous reign.

Meet Bharat Ramamurti. He has never run a business, nor has he ever worked for one.

Yet he’s the top economic adviser for the Kamala Harris campaign, and a not-so-covert socialist ideologue who intends to cripple the American economy through ruthlessly “progressive” taxation.

He may have first appeared on your radar Wednesday afternoon after his appearance on CNBC, during which he advocated for the campaign’s 25 percent unrealized gains tax proposal. The full clip is worth your time:

We discussed this proposal last week in The Dossier:

But Mr Ramamurti has long been operating within the power centers of the Democratic Party.

A Harvard and Yale Law School graduate, Ramamurti has never run a business nor held a corporate job. Nonetheless, he has plenty of “ideas” for how to manage the American economy.

Before joining the Biden Administration as Deputy Director of the

National Economic Council, he was Senator Elizabeth Warren’s (D-MA) senior counsel on economic policy for eight years. He has since left the Biden Administration for the Harris campaign.

Ramamurti’s commitment to progressivism (socialism) repeatedly revealed itself during his tenure with Senator Warren, when he spearheaded the senator’s signature proposal for a wealth tax, co-sponsored by some of Warren’s far-left colleagues.

The wealth tax sought to impose an annual tax on the wealth of individuals or families with “net assets” over $50 million. The wealth tax starts at 2 percent annually and rises to 6 percent for those with “net assets” over $1 billion. In short, it is a plan to “eat the rich” and have the government seize the wealth (again, on an annual basis) of people determined by the government to have done too well. Of course, these proposed taxes would come in addition to the taxes these individuals and families are already paying. It reveals a deeply embedded, committed socialist outlook on economics and individual rights, driven into Ramamurti during his time at Harvard and Yale, and defined by the notion that government can act as a fairer and more equitable distributor of wealth than free markets. Successful Americans must be punished for creating jobs and bringing value to society, Ramamurti argued, so it was time to shake them down and have the government redistribute the proceeds.

On X, Ramamurti became a fierce advocate for his staple initiative under Sen. Warren, declaring that the revenues generated by the wealth tax would result in all kinds of free stuff, like the canceling of student debt, in addition to free college and “universal child care.” A progressive utopia could be had, Ramamurti pledged, if only his fellow Americans would commit themselves to supporting his plan to Eat The Rich.

When he joined the Biden Administration, Ramamurti put the wealth tax stuff on the back burner. He instead became a force for shoving the DEI and ESG agendas down the throat of the American people.

“Mr. Ramamurti was among those pushing for more expanded relief that could help Black students and other students of color with particularly large debt levels,” wrote The New York Times.

“He was very conscious of racial equity and distributional impacts,” a top Biden adviser said of his work in the administration.

Now he is the point man for the Kamala Harris campaign’s push for an unrealized earnings tax, a hyper-progressive shakedown plan for an annual 25 percent minimum tax on “unrealized gains” of wealthy individuals. Similar to the idea for a wealth tax, unrealized gains would likely be calculated by massively expanding the government’s surveillance and censorship apparatus.

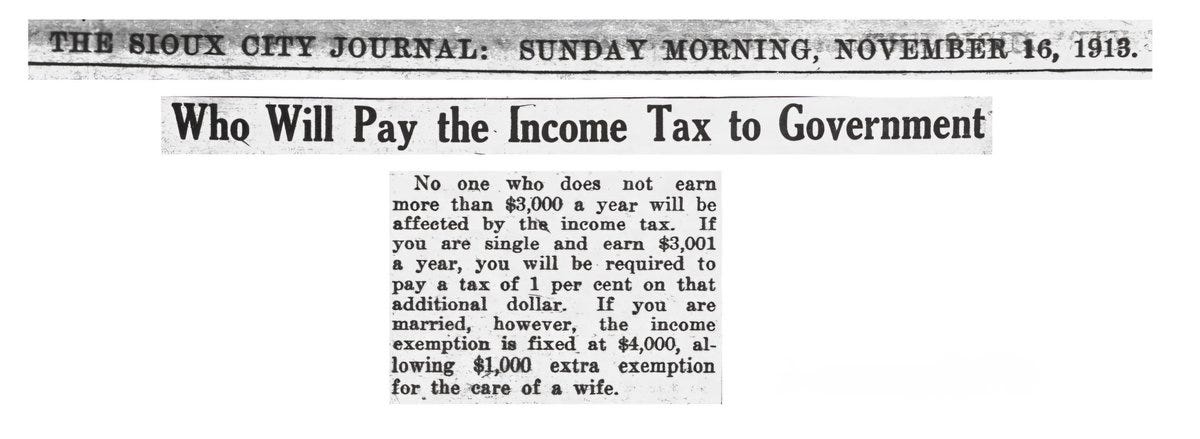

Both the wealth tax and the newly crafted unrealized earning tax are truly Orwellian concepts, which serves as the ultimate government power grab. America’s original federal income tax only applied to less than one percent of all households. It now applies to almost three-quarters of the country. These new tax policies would eventually envelop the nation, too.

Bharat Ramamurti is one of many dangerous ideologues who staff the Kamala Harris campaign and are likely to achieve top positions in a Harris Administration. Usually it's a bit of a political exaggeration to claim that the Democratic Party’s platform is nothing but lunatic socialism. But with this Kamala 2024 campaign, that's become a possible reality that America faces with the upcoming election in November.

TAXES = DEATH

And Kamala & Co. will tax America and her people out of existence.

They want you dead.

Do NOT comply.

Speaking as a Constitutional lawyer, It's true that the 16th Amendment did NOT provide an exclusion to the rule of apportionment among the States...nor did Obamacare, which was ridiculously classified as a tax by the Chief Justice...But you see, the US had to pay for a lot of foreign wars, and the Constitution was an impediment to that worthy enterprise....Otherwise, American citizens would have become too prosperous and healthy for their own good!

It has been clear for a very long time that federal taxes are wholly illegal having never been signed into law by the requisite number of states.

I remember a famous American comedian a few years back who had a popular show on TV and happened to be personally acquainted with the head of the IRS and he turned up one day at IRS headquarters with a camera, long before the days of Smart phones, and asked to see him. The IRS guy thought this was going to be some skit for the comedy show on TV and he thought it would be good publicity for the "caring sharing" IRS I guess so he agreed to an interview. The guy did ask a few jokey questions to get things going and the IRS guy was all very jovial about it until the guy asked him to point him towards the statute that gave the IRS the right to raise federal taxes. The head of the IRS gave a couple of waffley answers and then when it was clear this question was the real reason for the comedian's visit he turned aggressive and threw him out.

When the head of the IRS can't tell a comedian where the authority to steal your money comes from you can bet your bottom dollar it doesn't exist.

So don't pay it.