What makes the collapse of Silicon Valley Bank (SVB), formerly the 16th largest US bank, especially fascinating is that the usual bankster suspects responsible for letting Lehman fail in 2008 are in on this latest “bank run.” Of course, during the Great Financial Crisis banks and their depositors were not exposed to crypto, but the overall fracturing fractional reserve dynamics currently in play are not unrelated or in way unique.

The monetary policy monster that is Quantitative Easing (QE) had not been unleashed until sufficient societal fear was induced shortly after the arbitrary bank bailout scheme known as the Troubled Assets Relief Program (TARP). From COVID relief to bankster relief, the carefully selected keywords are always deployed to instill maximum panic and compliance.

QE not only remains in perpetual play as the Main Street to Wall Street redistribution function and Ponzi perpetuator tool, it also serves as the central planner’s (technocommunist’s) accelerant for the upcoming global financial market crash that will end all markets as we know them. This is all by design.

SVB, like Lehman, is a necessary failure in the greater central banking grand financial chessboard that the PSYOP-19 “pandemic” both rescued and (re)positioned for an even greater PSYOP-MARKET-CRASH collapse. At least that is the narrative the banksters and governments will be spinning for their Great Reset.

(There are many eerie similarities between 2008’s naked short selling which greatly contributed to the GFC now occurring in the [centralized] crypto space, and the gargantuan global derivatives ticking time bomb along with the untenable debt supercycle, all of which are respectfully long overdue for epic crashes as well.)

SVB may ultimately be considered the Black Swan event, but just like Lehman it was easily preventable if the globalist financial terrorists wanted a more stable economic system, which they clearly don’t.

As this substack continues to review the SVB debacle representing the 2nd largest bank failure in US history, the below article provides both an irreverent and deadly serious overview of this collapse.

"I learned that my assets were ephemeral, while my debts were money-good." - Rick Rule

If you’re looking for indicators, Scott’s voice is definitely rising. Wapner thinks the Fed is being mean to Silicon Valley billionaires. No tears yet though.

Bob is not helping matters: “We have a case of the Fridays here.”

Scott just said that this whole Silicon Valley Bank unpleasantness is “bullish” because the Fed will have to cut, or something. It’s mind-numbing, but funny.

People are gonna be working over the weekend now furiously going through the last known bank balance sheets and trying to calculate which banks are safe and which are potentially dangerous. As it turns out, in modern world bank can go tits up, zero from hero in a span of a day. Unless something happens, you will probably see other less safe banks go belly up by monday.

One Bank Folds, Another Wobbles and Wall Street Asks If It’s a Crisis “Silicon Valley Bank is just the tip of the iceberg,” said Christopher Whalen, chairman of Whalen Global Advisors, a financial consulting firm. “I’m not worried about the big guys but a lot of the small guys are going to take a terrible kicking,” he said. “Many of them will have to raise equity.”

Never believe anything in politics until it has been officially denied.

- attributed to Otto von Bismarck

Hey, let’s just set this straight right now: SVB is not a canary in the banking coal mine(!)

I’ve noticed this guy Armstrong over the years, and not in a good way. e.g., this, from October 2022:

Anyway, Armstrong makes the case that SVB Financial is different, this time, I guess. I sure hope so…

“It’s a unique bank.” - Gene Sperling (Sperling was the Clinton/Obama flunky who was the principal negotiator, along with Larry Summers, of the repeal of Glass-Steagall.)

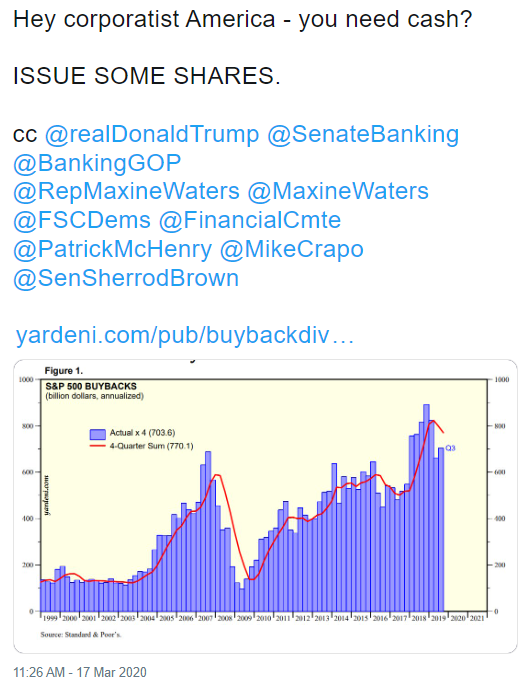

Maybe not so unique…(from 2020)

Six U.S.-based financial companies --Wells Fargo & Co., Citigroup Inc.’s Citibank, Fidelity Investments, Charles Schwab Corp., Northern Trust International Banking Corp. and Silicon Valley Bank -- as well as Israel’s Bank Leumi were subpoenaed in recent days by Virgin Islands Attorney General Denise George, who has filed a civil lawsuit against Epstein’s estate seeking to recover money and to pay his victims. National Financial Services LLC, a unit of Fidelity, also received a subpoena in the matter.

Classic Cramer. Good times (and almost exactly 15 years ago today).

I’m sure the Fed will save us (although if the Fed itself had to mark to market, that might be tougher.)

If you were wondering, the FDIC has about 1.3 cents in reserve for every dollar of deposits.

Apropos of nothing, the Fed got rid of bank reserve requirements back in March 2020.

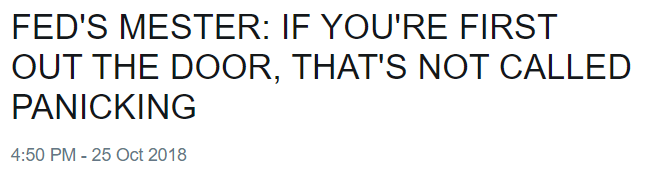

Don’t panic. As St. Bernanke taught us:

The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.

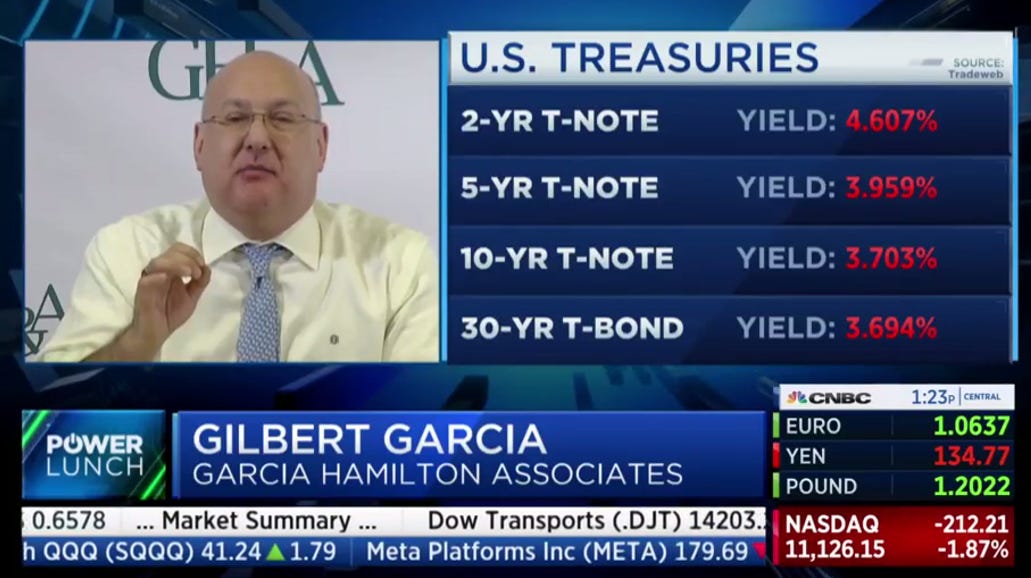

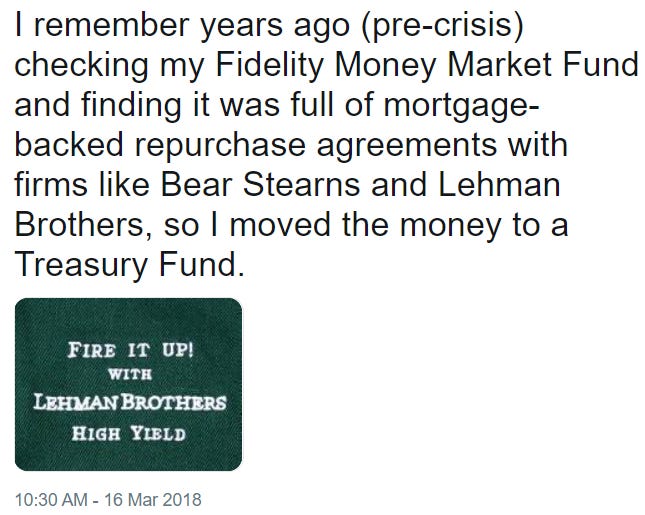

On a related note, like Pisani’s mom, earlier this week I moved a decent chunk of change (for me) from a bank (not Silicon Valley Bank) to T-Bills, at a yield close to 5% (as opposed to 0.01%), via Treasury Direct (first time since 2020). I’m sure I’m not the only one. The minimum is only $100.

Apparently, Silicon Valley Bank was “funded by over $173 billion in deposits (of which $151.5 billion are uninsured).” Not that most people have this problem, but anyone who goes over the FDIC limit at any bank is not too bright, in my humble opinion.

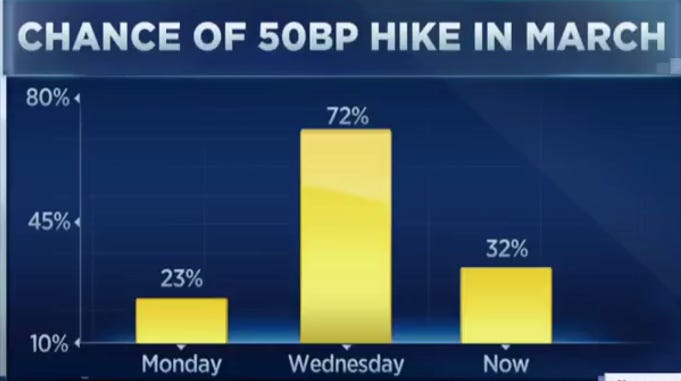

Rates are plunging today though, as everyone rushes to the safety of Treasuries (see Bernanke quote above.)

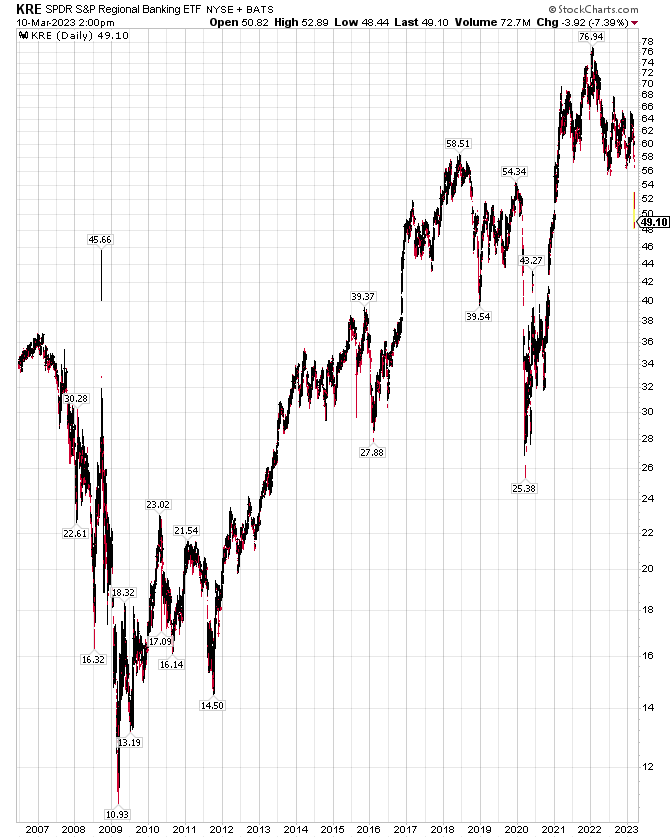

For what it’s worth, these banks are all way off their (so far) lows of Friday morning (as of when I’m typing this anyway):

You know, the Fed’s track record on bank regulation is pretty abysmal…

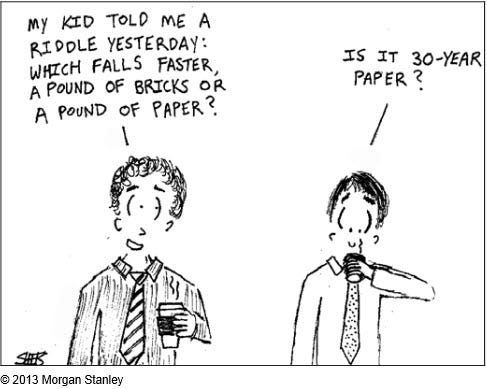

I’m reminded of a great Barron’s article from December 2007, “A Bullish Call: Wall Street's seers forecast more gains for stocks next year.”

THE STOCK MARKET HAS JUST EXPERIENCED its most volatile year since the current bull market began. Corporate profits shrank in the third quarter for the first time since early 2002. Record oil prices, housing deflation, rising loan defaults and tighter credit conditions threaten to tip the U.S. economy into recession. And a few weeks ago, it looked as if 2007's gains might disappear before the first strains of Auld Lang Syne.

Against this troubling backdrop, it's no wonder investors are worried that the bull market might end in 2008. But Wall Street's top equity strategists are quick to dismiss such fears.

Indeed, the dozen seers we've surveyed all have penciled in higher stock prices in 2008, although their estimated gains vary widely, from 3% to 18%. On average, the group sees the Standard & Poor's 500 at 1,640 by the end of next year, or about 10% higher than the recent 1486 with global growth and a benevolent Federal Reserve serving as twin crutches for the aging bull.

The S&P 500 ended 2008 around 903.

Abby makes an appearance:

"We expect the U.S. economy to show the strains of the deflating housing market and credit-market disruptions in early 2008," says Goldman Sachs strategist Abby Joseph Cohen. But "recession likely will be avoided, due to strength in exports and capital spending by corporations and government."

My favorite part was a Lehman guy talking about the "worst-case scenario" being a "10% to 15%" market drop.

Ian Scott, Lehman Brothers' London-based global equity strategist, says profits conceivably could fall as much as 45% if the U.S. slips into recession. But the stock market likely would fall no more than 10% to 15% from current levels even in this worst-case scenario.

And

Citi's Levkovich says prices already anticipate earnings growth that is 20% to 25% below the 20-year average. He calls stocks "screamingly cheap relative to bonds."

Tom “Thomas” Lee makes an appearance:

Thomas Lee begs to differ, however. "While the first half may look like death, second-half earnings will improve as the rate cuts take effect" and as easier comparisons take hold, says Lee, who became JPMorgan's main U.S. strategist after Chakrabortti left for Morgan Stanley earlier this year. A year ago, when he was still at JPMorgan, Chakrabortti had advised investors to underweight financials -- but Lee now expects the sector to "lead markets higher in 2008, even with the worst of the bad news on structured investment vehicles and write-offs still ahead."

Here’s the XLF over the next two years:

Read the whole article. It’s a great time capsule and also perhaps a warning.

I don’t often see “wildly prescient” and “St. Louis Fed” in the same sentence, but will wonders never cease: Wildly prescient St Louis Fed blog on bank bond investments

The St Louis Fed blog post by Carl White…points out that roughly 20 per cent of bank assets consisted of bonds (mostly MBS and Treasuries). By the end of 2021, security holdings had climbed to 25 per cent of assets.

Most of the increase was driven by Treasury purchases, and especially longer-maturity Treasuries, which suffer more when rates rise. Which, as many people will have noticed, they did last year.

To summarize, if you own a bunch of bonds, and rates rise, the price of the bonds drops. And I don’t even have an econ PhD!

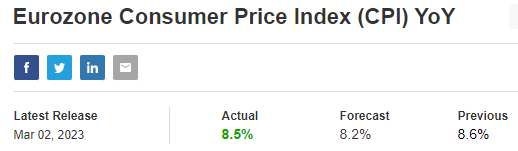

Meanwhile, in Europe

We now expect the ECB to raise its deposit rate to a peak of 3.75% at the middle of this year, with 50bp of rate hikes at each of the March and May meetings, followed subsequently by a 25bp increase in June. We previously expected the peak at 3% in March. Our baseline now sees a rate cut cycle beginning in December (rather than October before), with 25bp rate cuts continuing through 2024, to an end year level of 1.5%.

Inflation, of course, is a monetary phenomenon, “a decline in the purchasing power of the monetary unit of account,” but that does not mean it is self-explanatory. Havenstein was not printing money for the sheer pleasure of it, and he was not free to simply stop the presses. The money supply was increased to make possible the deficit financing of the budget, and the fact that this was done, the manner in which it was done, and the extent to which it was done were all the result of political and socioeconomic decisions taken by the government or of constraints felt by the government as a consequence of real or feared actions and reactions on the part of the groups and classes of which German society was composed. From the very outset, the significant determinants of the German inflation were structural ones.

- Gerald Feldman, The Great Disorder

I see that Billionaire Barry Sternlicht is again whining:

Barry Sternlicht says this is one of the best times in years to make commercial real estate loans. He regrets, however, that his firm can’t take full advantage of the opportunity…Starwood is “going to play defense” for the time being and do "virtually nothing" to protect the REIT’s liquidity. Sternlicht blamed the Federal Reserve raising interest rates seven times last year and one time so far this year for creating "incredibly tight conditions.”

I notice Sternlicht didn’t mind at all the Fed’s insane ZIRP policy, and all that irresponsible QE (especially the egregious Fed MBS monetization).

Barry’s front and center in the Cantillon Effect line.

Billionaire Sternlicht was on CNBS back in December with some choice quotes:

"This isn't FTX or anything." (actual quote)

"People think this is a run on the bank, this isn't a run on the bank.” (Who thinks this is "a run on the bank," Barry? Sara never mentioned that.)

"I'm looking at a building...we're the senior lender, there's a mezzanine position & there's the equity. I can tell you that the equity is probably gone, the mezzanine probably owns the building. There's gonna be a lot of that...a reshuffling of the chairs..." (i.e., Capitalism)

It was a typically hard-hitting CNBS interview too.

Sara really held Barry’s feet to the fire:

Barry: "I myself bought some stuff online because it was so cheap."

Sara: "Air fryers? Did you stock up on air fryers?"

Barry: "I bought some furniture."

Sara: "People aren't investing in their home as much, as you said."

Barry: "Yeah"

I've noticed that guys worth $4.7 Billion don't worry much about the cost of living: “I think the number 2% is kind of arbitrary,” Sternlicht told Fortune. “And could it be 3% or 4%? That would be fine.”

“Inflation that is driven by wage growth is fabulous…You can pay higher rents…”

- Sternlicht

"Starwood Capital Group...hoovered up homes...to rent them out as corporate landlords. Unlike Opendoor & other iBuyers, private equity firms are buy-and-hold investors who own homes for many years."

Sorry kids. You will own nothing, and pay rent to Barry Sternlicht.

Of course Sternlicht, like many billionaires,presents himself as only looking out for the little guy, but that's not it. Higher rates mean lower returns for Barry. That's it. He's talking his book. One reason you can't buy a house is because Barry owns (at least) 3,000 of 'em.

I see this all the time on CNBS when some billionaire’s net worth is threatened. They comes on to cry on Wapner’s shoulder about how mean the Fed is, and how they only care about the little guy…Sternlicht, Ackman, Asness, Cooperman, Fertitta Et al.

They all turn populist and claim to care about "capitalism," and the “poor guy,” but what they really love is the form of fascist capitalism we have - a big business & big government partnership - where guys like Sternlicht almost always get bailed out, while Joe Six-Pack gets capitalism.

Some people wonder why young Americans are now more open to "Socialism." Well, maybe it's because they got the impression that bailing out Lloyd Blankfein et al. in 2008 while they were foreclosed on was "saving capitalism."

It is not the responsibility of the Federal Reserve--nor would it be appropriate--to protect lenders and investors from the consequences of their financial decisions.

Ben Bernanke, Citadel and Pimco Intern, October 15, 2007

“Do you know that crappy strip mall around the corner from your house, the one with that liquor store and nail salon, and donut shop?” he tweeted on a recent Sunday evening. “It’s a gold mine. Very few understand this.”

I love a guy like Edward Luce, who “was previously the speechwriter for the US Treasury Secretary, Lawrence H. Summers, in the Clinton administration” writing in the FT about how messed up Russia’s finances are.

You cannot get through the density of the propaganda with which the American people, through the dreaded media, have been filled and the horrible public educational system we have for the average person. It’s just grotesque.

- Gore Vidal (I think the interview was from Summer 2004)

From a year ago, today…

MacroVoices #366 Louis-Vincent Gave: Staying Humble in Troubling Times

When we seized the Russian assets, and when we seized all the oligarchs houses, and football clubs, and central Bay Beach houses and whatever else. We sent a message to the world, that the law doesn't apply equally to everyone. And individual people will be judged, not on what they've individually done, but on who they are, not what they've done. So now all of a sudden, if you're Chinese, if you're Saudi, if you're from Brunei, or Qatar, you might not feel as secure owning US Treasuries, as you did before…

The reality today is for everybody saying is China's uninvestable. Well, it's uninvestable for American pension funds. Sure. It's not investable for the Abu Dhabi Investment Authority. It's not an investable for the Kuwait Investment Fund. It's not not uninvestable for the Saudis and they're pouring money in there. Because actually, for them, as crazy as it sounds to a Westerner, China might increasingly be more safe than the US. And so once you remove that safety aspect from the US Treasuries, what are you left with? Well, you're left with an asset class, that is that is falling all the time and that is deeply unattractive.

- Louis Vincent Gave

The idea that as a retired investor you should have a substantial investment in bonds, in my opinion, is ridiculous, in a world of paper money and negative real yields. Absolutely horrible advice.

Cathie Wood’s Ark Investment Management has earned more than $300mn in fees on its flagship exchange traded fund since its inception nine years ago, while wiping out almost $10bn of investors’ cash in the same period…Ark has earned more than 70 per cent of its $310mn fees since the fund’s valuation plummeted by nearly three quarters from its high in February 2021, according to FactSet data.

Meet the decade's best-performing U.S. diversified stock mutual fund: Ken Heebner's $3.7 billion CGM Focus Fund, which rose more than 18% annually and outpaced its closest rival by more than three percentage points.

Too bad investors weren't around to enjoy much of those gains. The typical CGM Focus shareholder lost 11% annually in the 10 years ending Nov. 30, according to investment research firm Morningstar Inc…shareholders often buy a fund after it has had a strong run and sell as it hits bottom.

Thanks, amigos, but I think I’m done with Twitter, even if they un-ban me.

Do NOT comply.

Thanks - have you seen Webb's latest. Just posted it.

https://georgewebb.substack.com/p/malones-big-domane-lie-is-crashing

EXCELLENT post. Need to digest after the first read, then read again, and save.