“Nemo agit in seipsum.”

No man acts against himself.

Under color of law, blatant fraud, and ignorance of law the unconstitutional imposition of direct and un-apportioned taxation (i.e. “income” taxes) was foisted upon We the People.

This is not “anti-government” conspiracy theory. This is legal fact.

The illegitimate Federal government operating out of the foreign nation of Washington, D.C. is waging a full spectrum soft-war against its citizenry, actively diminishing its subjects by threat of violence through counterfeit laws, with taxation having always been an especially potent control knob.

This substack has previously exposed taxation as illicit social engineering through the “Death and Taxes” meme which paved and paid the way for other criminal ideological State programming such as “Trust the Science”:

Since the passing of the unconstitutional and some argue unratified 16th Amendment in 1913, with the associated Title 26 U.S.C. of the Internal Revenue Code (IRC) complied in 1939, Congress has been engaged in the willful subversion of its duties and as such legislating against the very citizenry they pretend to represent.

The unlawful IRC is currently 3,837 pages long. The average person would be so daunted and overwhelmed to even think of perusing such an overlong and byzantine document, let alone questioning its legalities. Add in the lifelong indoctrination and the crescendoing “Death and Taxes” fears heading into each and every every tax season and we end up with an ignorant majority of compliant citizens. The fact that the judicial system is also indoctrinated to not uphold the Constitution allows for a hopelessly corrupt system that reinforces its own slow death spiral.

If one were to actually parse the IRC tax code, then they would realize that it is nothing more than an exercise in sleight of word and purposely deceptive terms with the aim and purpose to confound the citizenry such that they undermine their own best interests.

But what exactly is being paid in these “income” taxes, and to whom?

Nature of Federal income tax.

56. Every payment of Federal income tax is classified as a gift and 100% of all collections of income tax are used by the Secretary of the Treasury to make payments of interest on the debt owed by the Federal government to the private Federal Reserve Bank; to wit:

(1) The Secretary of the Treasury may accept, hold, administer, and use gifts and bequests of property, both real and personal, for the purpose of aiding or facilitating the work of the Department of the Treasury. . . .

(2) For purposes of the Federal income, estate, and gift taxes, property accepted under paragraph (1) shall be considered as a gift or bequest to or for the use of the United States. Title 31 U.S.C. § 321(d).

BEQUEST. A gift by will of personal property. [p. 339] . . . GIFT. . . . A voluntary, immediate, and absolute transfer of property without consideration. . . . [p. 1352] BOUVIER’S, pp. 339 and 1352, respectively.

Resistance to additional income taxes would be even more widespread if people were aware that . . . 100 percent of what is collected is absorbed solely by interest on the Federal debt . . . In other words, all individual income tax revenues are gone before one nickel is spent on the services which taxpayers expect from their Government. J. Peter Grace, “President's Private Sector Survey on Cost Control: A Report to the President,” Vol. I, January 12, 1984, p. 3.

The Federal Reserve is not an agency of government. It is a private banking monopoly. . . . [T]he policies of the monarch are always those of his creditors. Rep. John R. Rarick, “Deficit Financing,” Congressional Record (House of Representatives), 92nd Congress, First Session, Vol. 117—Part 1, February 1, 1971, pp. 1260-1261.

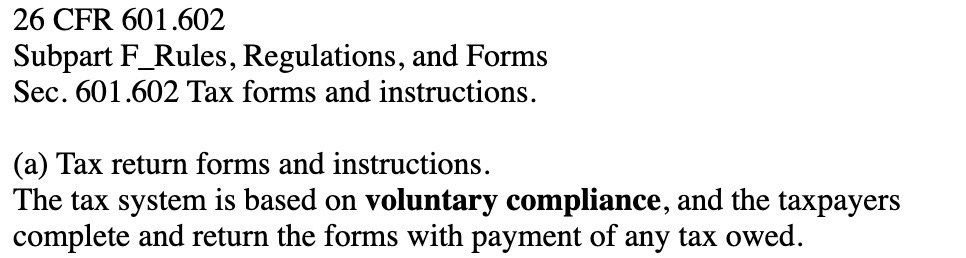

A gift is by definition voluntary, and this is further corroborated in the actual tax return forms; to wit:

Therefore, income taxes are gifts to a privately owned central bank that attenuates the inflation (stealth tax) that it purposely generates through monetary policies which serve to enrich their owners at the expense of the increasingly impoverished populace.

The Federal government continually accrues ever greater debt owed to said private bank which in turn is owed by We the People. The Treasury and its IRS run cover for both the Fed and Congress. The secondary benefit of this scheme is that theft of “disposable income” through taxation also serves to increase the propensity to borrow from the very Fed owners; namely, the banksters and ultimately the dynastic banking families at the very top of the Cult pyramid.

What we then have is a disguised feudal model, with “capitalism” as merely a cosmetic term for today’s crony capitalism, which is essentially communism 2.0 with more perks and smoke and mirrors, or technocommunism.

This tyranny can only be made possible by a captured Congress ceding one of its most critical functions:

"The Congress shall have power ... to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures."

Getting back to the nature of Federal income tax, which American citizens are then in fact responsible for this “voluntarily” filing for exorbitant “gifts”?

Code of Federal Regulations: only D.C. residents liable to tax under Title 26 U.S.C.

44. The correctness of our interpretation of the meaning of “State” (supra, paragraph 39), that the only body politic liable to tax under 26 U.S.C. is that of the District of Columbia, is confirmed in pertinent part of general legislation in Title 26 C.F.R. Internal Revenue; to wit:

§ 1.1-1 Income tax on individuals.

(a) General rule. (1) Section 1 of the Code imposes an income tax on the income of every individual who is a citizen or resident of the [Title 26 U.S.C. geographical] United States [i.e., District of Columbia only] . . .

(b) Citizens or residents of the [Title 26 U.S.C. geographical] United States [i.e., District of Columbia only] liable to tax. . . .

(c) Who is a citizen. Every person born or naturalized in the [Title 26 U.S.C. geographical] United States [i.e., District of Columbia only] and subject to its [the District of Columbia’s] jurisdiction is a citizen. . . .

45. Whereas: Only citizens or residents of the Title 26 U.S.C. geographical United States are liable to tax under Title 26 U.S.C. (26 C.F.R. 1.1-1(b)); and

Whereas: Persons born or naturalized in the Title 26 U.S.C. geographical United States nevertheless are not citizens thereof unless they are also subject to Title 26 U.S.C. geographical United States jurisdiction, i.e., unless they are also a resident thereof (26 C.F.R. 1.1-1(c)); to wit:

RESIDENT. One who has his residence in a place. BLACK’S, p. 1032. RESIDENCE. Living or dwelling in a certain place permanently or for a considerable length of time.

The place where a man makes his home, or where he dwells permanently or for an extended period of time.

. . . “Residence” means a fixed and permanent abode or dwelling-place for the time being, as contradistinguished from a mere temporary locality of existence. . . . Id.

—Territorial jurisdiction. Jurisdiction considered as limited to cases arising or persons residing within a defined territory, as a county, a judicial district, etc. The authority of any court is limited by the boundaries thus fixed. . . . [Underline emphasis added.] Henry Campbell Black, A Law Dictionary, Second Edition (West Publishing Co.: St. Paul, Minn., 1910), p. 673.

Whereas: For purposes of income tax under Title 26 U.S.C., it is immaterial if one was born or naturalized in the Title 26 U.S.C. geographical United States if he does not reside in the Title 26 U.S.C. State of District of Columbia (see paragraph 39, supra), i.e., is not a resident thereof,

Wherefore: The only persons who are liable to tax under the Internal Revenue Code / Title 26 U.S.C. are residents of the District of Columbia.

As per the actual code, only residents of the District of Columbia are required to pay taxes, and by extension Federal government employees.

So then how can the IRS lay claim on all 50 States of the union, if the District of Columbia is only one “State” which is not by law part of the union, and as such is a de facto foreign nation within the collection of the united States of America?

Meaning of the term “State” in 26 U.S.C. 6103(b)(5)(A)(i).

53. The meaning of the definition of the term “State” in 26 U.S.C. 6103(b)(5)(A)(i) comprehends the (a) (purported) 50 bodies politic of the District of Columbia residing without the exterior limits of the District of Columbia (supra, paragraph 52), (b) the body politic of the District of Columbia residing within the exterior limits of the District of Columbia, and (c) the body politic of the Commonwealth of Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands.

Meaning of the Title 26 U.S.C. term “State”.

54. The meaning of the controlling Title 26 U.S.C. definition of “State” in Section 7701(a)(10) thereof— which provides “The term ‘State’ shall be construed to include the District of Columbia, where such construction is necessary to carry out provisions of this title”—is identical to that of 26 U.S.C. 6103(b)(5)(A)(i), supra, paragraph 53.

Meaning of the Title 26 U.S.C. term “United States”.

55. The meaning of the controlling Title 26 U.S.C. definition of “United States” in Section 7701(a)(9) thereof—which provides “The term ‘United States’ when used in a geographical sense includes only the States and the District of Columbia”—is the collective of the geographic area occupied by the District of Columbia, the Commonwealth of Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands and no other thing.

Therefore, only in the act of filing an “income” tax form from outside of the geographical location of the District of Columbia does one then choose to voluntarily opt-in as a resident of the District of Columbia while physically residing outside its territory.

By volunteering to become a resident of the District of Columbia when one’s legal status is as a nonresident alien, one thus participates in and comprises the District of Columbia as the body politic residing within the 50 States.

When citizens from within the 50 States, ignorant of the purposely misrepresented tax code “law”, volunteer to file their “income” taxes they are electing to create the body politic of the District of Columbia, whereby the IRS then claims to have jurisdiction over them.

In other words, by filing “income” taxes you have given over your legal rights to the IRS by tacitly agreeing to become a subject of the “State” of the District of Columbia. You are in effect signing off on a legal document that is purposely designed to swindle you, and as such you have no further recourse by entering a binding contract.

The fact that IRS agents are also ignorant of the code and are just as brainwashed as the judges and the citizenry further guarantees mindless compliance.

But the IRS does not have any jurisdiction to collect a cent from any nonresident alien in any of the 50 States unless said citizens file tax forms.

No requirement for nonresident aliens to make an income tax return.

48. The Federal Register, published by the Office of the Federal Register, National Archives and Records Administration, and the official daily publication for all rules—i.e., statutes—proposed rules, and notices of Federal agencies and organizations, as well as all presidential documents, is devoid of incorporation any requirement to make an income tax return; to wit:

Our records indicate that the Internal Revenue Service has not incorporated by reference in the Federal Register (as that term is defined in the Federal Register system) a requirement to make an income tax return. Michael L. White, Attorney, Office of the Federal Register, letter to Richard Durjak, May 16, 1994.

This is one of the most egregious examples of color of law. Any court enforcing this kind of theft is breaking the law of the land. Most if not all judges presiding over “income” tax cases as well as juries are guilty of this.

Note how one must elect themselves in order to be legally stolen from; to wit:

How Joint Tenants in the Sovereignty “become residents” of the District of Columbia.

49. Any nonresident alien, such as a Joint Tenant in the Sovereignty, can appear—in the eyes of government—to elect (choose) to be treated as a resident of the District of Columbia by making a tax return; as provided in 26 C.F.R. Sections 1.871-1 and 1.871-4 and 26 U.S.C. 6013; to wit, respectively and in pertinent part:

[…]

50. Whereas, no nonresident alien has a duty to make a tax return, such return can be used by government as “evidence” of a “definite intention to acquire residence” in the Title 26 U.S.C. geographical United States (see 26 C.F.R. 1.871-4(a) and (c)(2)(iii), paragraph 49, supra).

Who in their right mind would elect themselves to be a willing participant in this kind of deranged arrangement?

The Framers were acutely aware of the tendency for a government to engage in the theft of the fruits of its citizens’ labors. This to them constituted a perversion of natural rights, God given rights, and directly limited an individual’s freedoms, property rights, and the very Constitutional rights that they prescribed for their Republic. (An important yet subtle note: The Constitution was never meant to be “of” The United States of America as it is currently presented. It was always meant be “for” The united States of America as originally written by the Founding Fathers. It is the “of” that allows for color of law, unconstitutional amendments, laws and codes as this altered word erroneously presupposes that the law of the land emanates from the States, whereas the real law of the land can only derive from the Constitution itself and is therefore immutable and all-encompassing.)

No matter how much the government steals via “income” taxes, even when the marginal tax rate for U.S. earners was 94%, its deficits are always unsustainable, precisely because “income” taxation has no direct bearing on government budgets. The IRS is simply backstopping the Fed’s ruinous policies. And if the metastasizing government did in fact rely on “income” taxes, then why would Congress not take back from this private central bank their power to print money and directly fund their profligate budgets and associated money laundering black ops schemes?

If the government always required “income” taxes, then how was infrastructure paid for, how were hospitals and firehouses built, who paid the police and firemen and schoolteachers prior to the modern era income tax in the “temporary” Victory Tax by the Revenue Act of 1942? That wartime “income” tax was incidentally repealed two years later, but the citizenry was never informed so they kept offering up their ever increasing “gifts” to this very day.

Therefore, Occam’s Razor tells us that “income” taxation is wholly unnecessary for a legitimate Federal government. It then follows that taxation is used to oppress, stress, induce debt, and limit We the People in their freedoms. It is a subjugation tool and the most pernicious example of social engineering designed to control and deprive the citizenry, looting personal prosperity and the ability to accumulate generational wealth through hard work and creativity.

The second Plank of the Communist Manifesto states:

A heavy progressive or graduated income tax.

What we have today is technocommunism, with “income” taxation a vital component of the Great Reset.

The 4th Industrial Revolution requires the constant destruction of wealth and freedom, which is precisely why PSYOP-CLIMATE-CHANGE is in no small part is an all-encompassing taxation scheme.

But even if one appreciates the true nature of “income” taxation and how it does not apply to the nonresident alien, this system has been designed to make it next to impossible to extricate oneself from the burdens of needlessly paying these grievous “gifts”.

Every corporation and most businesses comply with this IRS scam. The IRS relies on the employer to function as their entrapment agent for their employees. These employers aid and abet the IRS by withholding Federal “income” tax from their employees, thus electing them to becoming “voluntary” residents of the foreign nation “State” of the District of Columbia. This act of withholding “income” legally binds the employee to the IRS by requiring them to filing their tax forms. The legal liability is thus transferred from employer to employee, yet legally the former has no responsibility to withhold.

Since the District of Columbia also happens to be harboring a wholly illegitimate Federal government that it in turn empowers the IRS and Fed to continue to perpetrate their theft, thus allowing for an unconstitutionally vicious negative feedback loop.

And even if one is able to successfully navigate the unwarranted imposition of these “gifts” to the Fed via the IRS, governments have now escalated their weaponization of the tax code by forcing companies such as eBay and Paypal to report any and all transaction exceeding $600.

Concurrently, the hard push by the WEF “penetrated” nations for CBDC’s is also directly related to this taxation social engineering, with Israel recently ratcheting up their cashless society ploy; to wit:

The very same corporations and businesses that volunteered their employees to gift away the fruits of their labors also pushed the DEATHVAX™ on them with discriminatory and hence illegal threats of job terminations. Many employees were fired over these EUA injections and the fraudulent mandates.

The greatest irony is that all of those “free” DEATHVAX™ injections were and continue to be funded by the taxpayers that are now experiencing skyrocketing all-cause mortality and a plethora of AE’s.

If a socially engineered, miseducated, propagandized and mass formation psychosis’d citizenry is ignorant of the law of the land, then what are the chances that they could even appreciate the concept of informed consent?

The global citizen is a debt-slave tax mule genetically modified human careening toward their mass ritual suicide.

PSYOP-IRS has been one of the more effective means of destroying lives, freedoms and liberties.

PSYOP-CLIMATE-CHANGE perfectly leverages all of the other psyops into a singular and permanent masked up, locked down, never-ending gene therapy and nano-mind control surveillance injection program inextricably tethered to the social credit score system. In this posthuman dystopia taxes will continue to play an integral part of the control apparatus. A.I. as set by technocratic overlords will algorithmically impose taxes and inflate away UBI at will, with the ultimate taxation being levied on those whose productivity thresholds trigger the “freedom” to be euthanized.

Taxation in no small part is what got us to these our horrific technocommunist crossroads. If we continue to act against ourselves, then we continue allowing the powers that be to drain our life force from us.

There are far more of us than their are IRS agents, cops and technocrats. What can they really do if there is mass noncompliance?

The truly free person sees through all of these psyops and scams. They circumnavigate the illusions of power and color of law. They are nonresident aliens of any states of being that go against their natural rights and spirit.

Read the entirety of Memorandum of Law here.

Do NOT comply.

As a Canadian, I'd be willing to bet we've got similiar tax laws and language around our financial institutions. Steep learning curve, but one which we'll have to undertake in order to grasp the enormity of the fraud being perpetrated against the people. I've been on this journey since 911/2008 financial meltdown.

I am sure this is a naive question, but in light of this, why not a class action lawsuit against the IRS or whatever needs to be done to get peoples attention? Seems like we should all be trying to do something about it instead of just talking about it. I obviously do not know the system as well as you which is definitely part of the problem! But I do want to learn more about the codes.