PSYOP-MARKET-CRASH: Social Engineering COVID-19 Into The Banking Crisis That Triggers The Global Financial Collapse

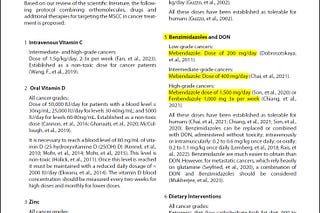

This substack had been warning that the PSYOP-19 global depopulation and control program was the setup. The follow-up was always going to be yet another One World Government operation to further consolidate power and usher in the Great Reset.

As predicted over two years ago, PSYOP-MARKET-CRASH was one of the more viable post “pandemic” follow-ups for these sociopathic technocrats.

It now looks like this substack’s thesis that the SVB bailout was merely for optics, and that the whole system would start to unravel shortly thereafter may have been right on the money.

The perpetrators now have the excuse that while they attempted to bail out the banking sector, due to the severity of the systemic instability they were unable prevent the greater collapse.

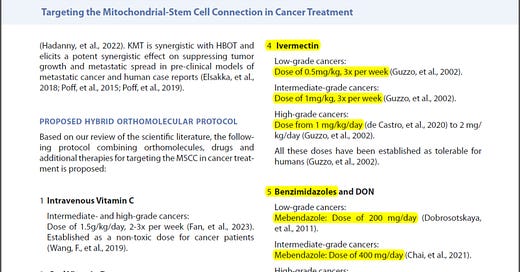

What is missing in the above tweet is the deflationary slow kill bioweapon injections which have caused unprecedented surges in mortality, disabilities, workforce participation distortions despite the best efforts of fraudulent government agencies like the Bureau of Labor Statistics, etc.

And if anyone had any doubts that the perpetrators of the globally coordinated PSYOP-19 scamdemic are the very same cabal that is behind today’s PSYOP-MARKET-CRASH, then let us consider the role of the global central banks working in concert under the guidance of the central bank of central banks known as the Bank for International Settlements (BIS).

The privately owned Federal Reserve Bank is wholly responsible for this current banking crisis, just as it had been responsible for all of the boom and bust cycles that it was founded in 1913 to allegedly prevent. In fact, since the Fed’s creation the amplitude and severity of market cycles has been deliberately exacerbated such that its owners made profligate profits on the way up only to then buy everything back for pennies on the dollar when they central planned the demolition of the economy through their criminal monetary policies and mandates.

Just like the Fed caused the Great Depression, the 1987 crash in coordination with the Depository Trust & Clearing Corporation that they happen to own, the Tech Bubble crash, and the Great Financial Crisis, they were also the reason that SVB and Signature Bank were seized or “nationalized” by the government.

In the lead up to the Great Depression the Fed was deliberately buying up treasuries in order to dump them to set off the 1929 Wall Street crash. Today, the Fed is committing the same slow crash, but with the manipulation of interest rates, which may be defined as the price of money; in other words, when the free market is unable to determine the price of money, there are no free markets.

By raising rates after forcing them to remain zero bound (ZIRP or zero interest rate policy which was always NIRP or negative interest rate policy when adjusted for inflation), the Fed caused SVB’s book value to go down since those very monetary policies drove banks to buy longer duration treasures and bonds. These are considered “safe” investments, until the central planners change the rules yet again mid-game, which they always do. And then the Fed raised rates sharply (the above chart equivalent of the Fed dumping treasuries in 1929) which induced significant market risks that lead to credit risks that directly caused liquidity problems for smaller regional banks like SVB and Signature Bank.

Since neither SVB or Signature Bank were technically insolvent, the only way that they could only be put out of business quickly was via the liquidity angle. If the Fed wanted to keep these banks alive it could have easily injected all the liquidity that SVB and Signature required in the time it takes to depress the CTRL +P keys.

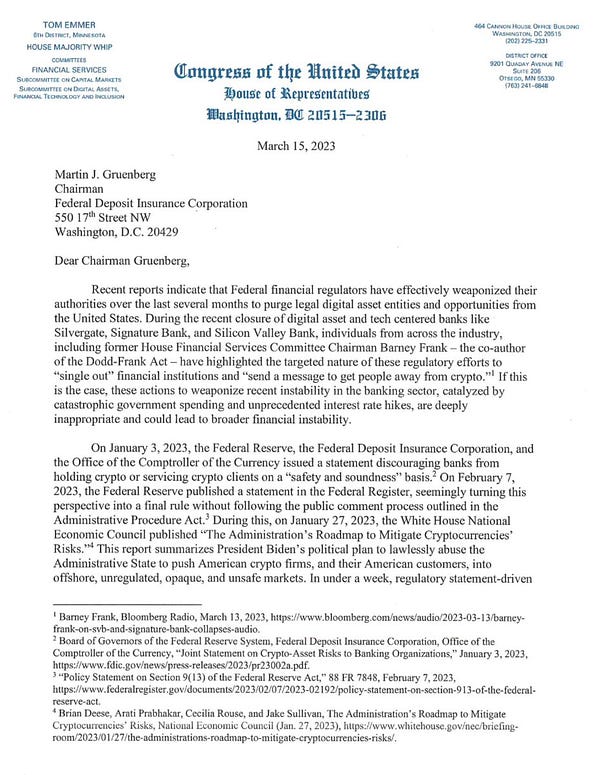

But the Fed’s mission was the exact opposite of rescuing smaller banks and ensuring price stability. One of the Fed’s main objectives was always to wipe out what was left of the community banking sector that its founders had not managed to completely obliterate shortly before instituting the Federal Reserve Act of 1913, the very same year that the unconstitutional 16th Amendment was snuck through. And so as usual the central planners required a little help from their partners in crime in order to expeditiously blow up these banks.

Enter Deep State operator and billionaire Peter Thiel, who was instrumental in rallying companies and investors to commence the bank run on SVB. Naked short seller Marc Cohodes who happened to have CIA and mob ties when he was instrumental in bankrupting many profitable companies leading up to the 2008 crash brought up the cavalry with his usual insider “research,” thus ensuring that the likes of FTX, Signature and Silvergate would also all go under within a short span of each other and SVB in a perfectly coordinated attack.

The real reason the Fed and its network of co-conspirators went after these smaller banks was to go after the tech startups and crypto firms that they were catering to.

Is it any wonder then that the CEO of SVB sits on the board of the San Francisco Fed?

Or is it any wonder that retired congressman Barney Frank who also happens to have been the co-author of the Dodd-Frank Act to tighten bank regulations after the 2008 financial crisis sat on the board of Signature Bank?

The 82-year-old Democrat is on the board of directors at Signature Bank — a New York lender that was shut down by state regulators over the weekend, becoming the industry’s third major casualty since Silicon Valley Bank was abruptly shuttered on Friday and the crypto-focused Silvergate Capital shut down a week earlier.

In an interview with Bloomberg late Sunday, Frank partly blamed cryptocurrencies, which hadn’t existed when he and fellow lawmakers in Washington were grappling with the collapse of Lehman Brothers in 2008.

“Digital currency was the new element entered into our system,” Frank told Bloomberg. “A new and destabilizing — potentially destabilizing — element is introduced into the financial system. What we get are three failures.”

Of course, useful idiot apparatchiks like Frank would blame the biggest threat to the Fed and its shadowy owners.

The Fed and the illegitimate Federal Government that it is coordinating with wants total control of BigTech and crypto. In the process, they also went after Circle and its stablecoin product USDC, further attempting to destabilize the crypto space that poses the greatest risk to their upcoming dystopian CBDC scheme.

The CBDC is the ultimate instrument in the UN, WEF, CFR et al. Great Reset global financial takeover. And to this end just like PSYOP-19, the globally coordinated PSYOP-MARKET-CRASH requires the other central banks to participate in reinforcing and accelerating the burgeoning American banking crisis into a full-blown worldwide contagion phenomenon.

Enter the European Central Bank (ECB), which today in the face of a global banking crisis hiked interest rates by half a percentage-point. Putting the identical pressure on EU banks that the Fed did with their respective hiking policies just as Credit Suisse comes under extreme pressure is no mere coincidence.

The latest catalyst in crashing Credit Suisse’s stock price is Saudi Arabia and its Saudi National Bank, which happens to be its largest shareholder, threatening to pull out of the beleaguered bank.

While the Ivory Tower fraud that never worked a day in the private sector in her life Janet Yellen did an about face and promised to backstop all SVB depositors (strictly for optics) including the CCP depositors which constitute the majority of accounts over $250k at SVB, and as the FDIC promised to ensure all depositors even though it has less than a fraction of a percent of funds in its coffers to actually pay out said depositors all while the Fed refused to provide liquidity, the Swiss National Bank has stepped up with liquidity guarantees to Credit Suisse:

The Swiss National Bank is also just providing optics ahead of the collapse, which gets them off the hook just as it does the US Treasury, Fed and FDIC; that is, they now have the appropriate excuses when their staggered demolition of the global financial system hits critical mass.

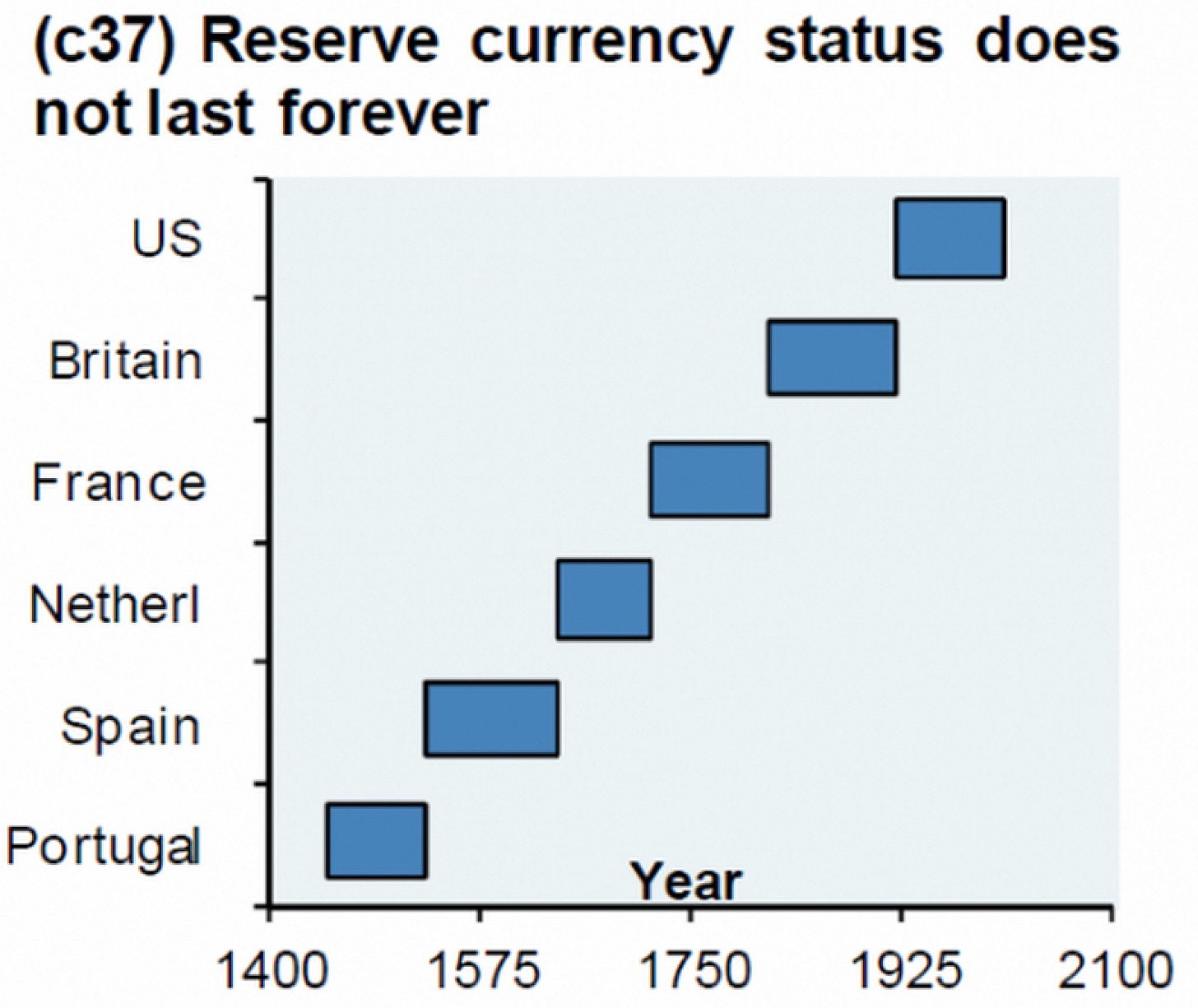

And Saudi Arabia’s threat to abandon Credit Suisse simply reinforces their telegraphed pivot away from the West and the petrodollar to the BRICS nations. This too speeds up the demise of the petrodollar reserve currency which is rapidly nearing its end; to wit:

It is important to appreciate that the BRICS nations are also controlled by the One World Government that has pitted them against the very West that it too controls.

As Russia turns to China’s Yuan and away from the dollar, and as the illegal proxy war and the associated Western sanctions have been net profitable for Putin, the BRICS collective only grows stronger precisely because for the Hegelian dialectic problem/reaction/solution game to effectively work on the populace, the ‘good guys’ (thesis/West) must be confronted with an increasingly emboldened and powerful ‘bad guys’ (antithesis/East) which serves to usher in the One World Government outcome (synthesis/Great Reset/Agenda 2030).

The same dynastic banking families, the Rockefeller crime syndicate, various Fed owners like JP Morgan, Wall Street, et al. that funded the Bolshevik Revolution, the Chinese Cultural Revolution, as well as the NAZI party were always playing all sides against each other.

There are no true winners in these grand chessboard games, just levels of societal destruction and control.

These very same nefarious forces are today continuing to perpetrate the various manufactured crises, not limited to “pandemics,” financial collapses, wars, various false flags and other psyops as they persist in playing all sides and all persons against each other.

Having printed trillions under the cover of COVID-19 to further enrich themselves while impoverishing everyone else with diluted currency, with the banking sector now in turmoil the clandestine owners of the Fed realize that they are fast approaching the endgame of their global financial experiment: the debt supercycle is no longer tenable, and “markets” on the whole since the 2008 crash have completely decoupled from fundamentals.

By having generated massive inflation with their conjuring of fiat out of thin air (Quantitive Easing or QE), they are now in the process of drawing down the money supply (Quantitive Tightening or QT) while said inflation remains elevated or sticky, as liquidity precipitously evaporates a la 1929.

Readers of this substack know that the DoD, Pentagon, CIA, UN, WEF, WHO, CFR, Rockefeller and Gates “nonprofit” foundations, BigPharma (a corporate node and cover for the main players), various other Federal government agencies like NIH and their global counterparts, the CCP, et al. were all in on the PSYOP-19 program and the associated slow kill bioweapon DEATHVAX™ injections. But few appreciate that the Fed was always in on the bioterror Crimes Against Humanity operation. Not only did they supply “liquidity” to the various agencies and their bioterror projects while money laundering their black ops, but just like the Rockefeller foundations created allopathic medicine, the Fed literally funded “Trust the Science” for decades, if not longer.

In a 2011 interview that has literally been scrubbed from the internet, investor and financial insider Chris Whalen dropped an absolute bombshell:

The federal reserve controls the publication of all scientific research through the national science foundation.

And this is what Whalen said just the other day about this current banking crisis:

Big Picture: Is the crisis affecting US banks over? Not by a mile. In fact, to paraphrase our friend Josh Rosner in a client note: “The regulators have not gone far enough to address this crisis. Markets are aware of this and there has not been a full-throated enough or strong enough response from regulators or the Hill.” Ditto

The first thing we want to say to our readers is that both SVB and SBNY failed due to deposit runs, but for different reasons. In each case, idiosyncratic and even unprofessional behavior by management led to a bank failure, but the risks were greatly magnified by rising interest rates and QE. Today, we have several large commercial clients that continue to use both institutions, but only because of the guarantee on uninsured deposits.

[…]

When we say that the Yellen Banking Crisis is not over, what exactly to we mean? First, by creating a two-tier approach between large and small banks, Yellen is exacerbating the run by businesses away from regionals to the largest banks. Consider a recent report from our risk manage pal Nom de Plumber, who is currently embedded inside one of the larger TBTF zombie banks.

Remember, the CEO of SVB sat on the board of the San Francisco Fed and he 100% knew that his bank was being mismanaged and allowed it to go on. He sold large amounts of SVB stock ahead of the bank run, as did many of his employees.

But it’s way worse than just long duration treasuries. It turns out that ultra-toxic mortgage-backed securities (MBS) are in play today just like they were in 2008.

The Treasury debt and mortgage-backed securities (MBS) created during the 2020-2021 period of “Max QE,” are toxic waste despite the “AAA” rating. The fact of below-market coupons makes these securities unusually volatile and impossible to hedge. Why did the Fed even allow banks to buy these risky securities? Janet Yellen needs to address this issue publicly.

The big question that Steve Liesman, Nick Timaraos, Kate Davidson and our other colleagues that cover the Fed need to ask is this: Why did the Fed create Treasury debt and MBS that cannot be hedged? The hedge cost for a Ginne Mae 2.5% MBS, for example, is 2-3x the coupon. Why would anybody want to own this security (other than a central bank, of course)?

Bringing this back to COVID-19 as cover for the orgy of money printing, we see that during this “pandemic” unprecedented amounts of MBS were also churned out. That both treasuries and MBS can’t be reasonably hedged is beyond suspect.

So the very Fed that has been funding all of the “Trust the Science” publishing and executing “Max QE” because “science” turns around and does “MAX QT” because “fundamentals” (the 5th time in history that the money supply M2 has gone negative which always corresponds to a market crash, while the Fed has booked a $126B loss in February which is more than it has ever “earned” in an entire year, its shadow books notwithstanding), thus instigating another financial crash.

Another way to look at QE and QT is to track global central bank asset books and the major indices:

But central banks only step in for so long, and when the bubble that they blew is ready for popping they conveniently step aside:

The control of the money supply is ultimately the control of business cycles, or control of boom and bust cycles.

Many have speculated that the reason COVID-19 was (prematurely) deployed was due to markets locking up in 2019 during the repo crisis, with interest rates (prematurely) rising into early 2020 such that quadrillions in derivatives were also (prematurely) coming under pressure.

In this context we can now appreciate just why SVB and Signature Bank were targeted by the Fed and its partners in crime. Over 90% of tech startups banked with SVB. Just days after crypto exchange Coinbase announced its move to Signature Bank it was seized by the government along with SVB.

SVB, Signature, Circle, Silvergate, and even FTX all going under in such a short timespan is no coincidence.

Also not coincidentally, the following are being allowed to trend on the limited hangout social media platform:

The #Bankcollapse is the setup for the upcoming attempt at #Cryptocollapse.

The One World Government and their central banks are now targeting all decentralized crypto such that they can institute their hyper-centralized CBDC.

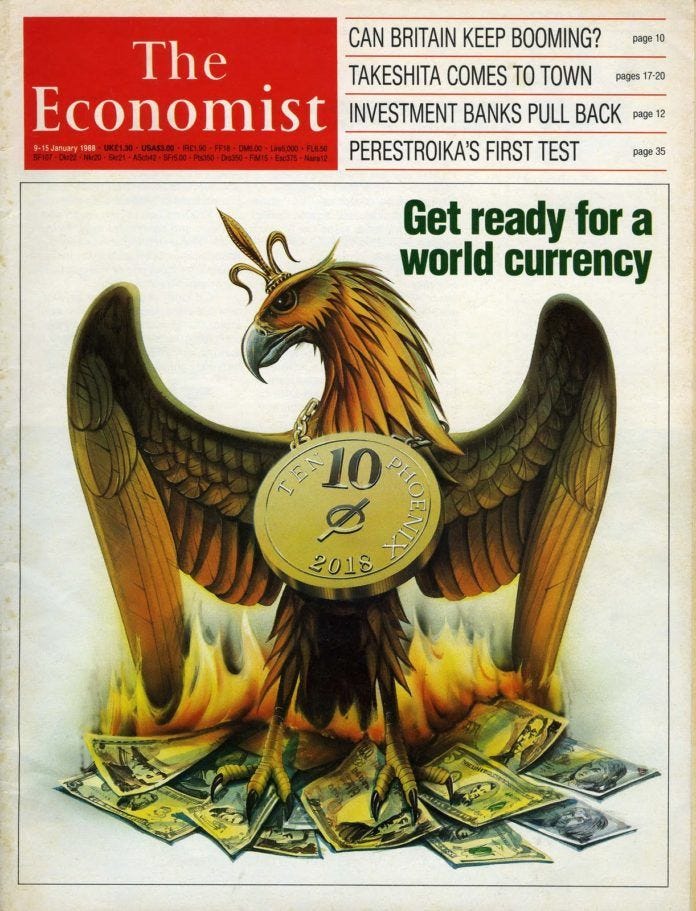

And what is the CBDC but the crypto version of the Special Drawing Rights (SDR) singular ‘world currency’ that the IMF has been developing and normalizing since long before this Rothschild-owned The Economist issue was released (note the cover date was 1988 and the date on Ten Phoenix SDR coin was 2018):

The IMF’s TEN 10 PHOENIX coin was set for deployment in 2018, or one year before COVID-19. The latter allows for the former, and the former allows for the WEF’s Great Reset to rise from the ashes of a world that they are desperately attempting to burn to the ground.

The CBDC component, or crypto SDR, or crypto PHOENIX coin requires that all small banking institutions fail, and that all depositors are herded into the too big to fail banks, which also happen to be part owners of the Fed.

Once every person and corporation is forced into these handful of big banks, and once the crypto exchanges are put out of business such that the only on and off ramps for current crypto tokens are these big banks, it becomes far easier to institute the CBDC.

All fiat and all crypto is then valued in terms of the singular ‘world currency’ CBDC.

Which is precisely why FDIC regulators are requiring prospective buyers of SVB and Signature Bank to agree to give up all cryptocurrency business at those banks.

Between the own nothing and be happy WEF ploy and the UN’s Agenda 2030 PSYOP-CLIMATE-CHANGE scheme, the CBDC becomes the critical instrument in consolidating the transition from debt-slavery to carbon-footprint-slavery, groupthink compliance, never-ending genetically modified posthuman updates (“vax” passports), bug gruel and synthetic tumorigenic meat rations as a function of the UBI tethered social credit scores (for calories), and ultimately allowing the State AI algorithm to grant the “global citizen” locked away in their 15 Minute City the “freedom” to be euthanized.

But just like the bivalent “vaccine” uptake has imploded with less than 15% of society now subjecting themselves to these poisonous boosters, so too are people getting wise to the central bankster CBDC power grab.

As the slow mass ritual biosuicide gradually reverses, we can be certain that the CBDC will fail. People are waking up to manufactured pandemics, wars, climate scams, and banking crises.

When We the People finally understand that the illegitimate Federal government that is waging a full spectrum soft war on us is not to be complied with in way, shape or form, then we will free ourselves from the current transhumanist tyrannies.

It is important to remember that ArtI.S8.C5.1 of the Constitution referring to Congress's Coinage Power states:

[The Congress shall have Power . . . ] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; . . .

When taking this into account, there is no way that a One World Government CBDC is legal. Just like there is no way for the WHO to control “pandemic” or any health responses in America. And there is also no legal way for a privately owned central bank to manipulate interest rates, money supply, or issue any currency not limited to a CBDC; thus, the Fed is operating strictly under color of law as is the Federal government.

Similarly, there is no legal means for the IRS to collect “income” taxes, which are nothing more than social engineering for the purposes of impoverishing We the People while simultaneously backstopping an illicit central bank that can print any amount of fiat at will.

Recently, well-meaning but misguided lawmakers in Tennessee held a talk on making gold and silver legal tender in their state, and as such not subject to taxation. They warned of the CBDC and how it could be used to lock people out of their bank accounts which would result in them being unable to pay their property taxes and thus they would lose their homes (stripping private property from people is the main goal of Agenda 2030). They proposed an escrow service such that home “owners” could prepay their property taxes. Of course, these lawmakers were ignorant of the intentions of the Founding Fathers who wanted We the People to have Allodial Property Title which means that no taxes nor debts may ever be levied on homes; that is, true private property ownership.

These lawmakers then surmised that if there were to be another civil war, then the succession of states would allow for Tennessee to become its own nation. What they failed to appreciate is that as per the Constitution, Tennessee is currently a sovereign nation within the collection of states comprising the united States. This is what State’s Rights actually means. They also did not appreciate that Washington, D.C. is a foreign nation with extremely limited functions as per the 10th Amendment, or the “rule of construction.” In other words, the Federal government is defined by the most strict construction as per the Constitution, while most power and authority remains with the states or with the people themselves as they determine in each state.

This is why well-meaning lawmakers and persons with incomplete knowledge are missing many of the crucial concepts and laws that allow for true freedom.

And all centralized systems are created with the express purpose of stifling freedom through violence.

The only way out of this CBDC nightmare is to build local communities, invest in precious metals, DeFi crypto, bartering, and various other decentralized strategies.

The liquidity of our life force must never be controlled by a central planner.

We must nonviolently remove ourselves from the Federal Reserve system which is now on its last legs, thus making it that much more dangerous for us all precisely because the dynastic technocratic criminals never voluntarily cede power.

Expect much more pain.

Good always defeats evil.

Do NOT comply.

Spot on 2nd SGITW. Well assembled piece on what we're witnessing. This is what must be done to set the stage: "The One World Government and their central banks are now targeting all decentralized crypto such that they can institute their hyper-centralized CBDC." But it will require going after companies like Gemini, Coinbase, all exchanges, all trading platforms, and many of them are offshore or with "virtual" addresses so they will need the help of other nations and their regulators, which won't be difficult under threat of BIS. But all stable coins are shit, just like fiat. And they'll have to blow up USDC, and the CIA preferred weapon of democrat party and Ukraine money-laundering- USDT- Tether. These are fractional reserve shit coins that they will collapse intentionally to completely destroy the crypto market to make it toxic and scare any investors away. SEC and Fed already control Tether so they're setting people up for a bomb. People will lose 100x what they lost on FTX. Then they'll have to pass a law banning the ownership of crypto, calling it illegal tender. Once BTC hits $4k and there is not a single exchange to purchase crypto which has been outlawed, only THEN the stage will be set to unleash CBDC with any chance in hell of success. They're watching what happens in Nigeria to learn what mistakes to avoid. This is all coming in the next 24 months. If crypto is still legal prior to this rollout, BTC will 100x rocket as everyone with any functioning brain runs to decentralized currencies. Even if they try to outlaw crypto, black markets will emerge and apps will rise, and people will transact outside their system of slavery. Sooner or later people will see their chains and flock to the alternatives (silver, gold, crypto).

All taxes are theft.

Get rid of taxes and you get rid of 99.99% of government caused problems.