PSYOP-MARKET-CRASH: The First Bank Failure of 2024 Leaves a 1-Cent Stock for Investors and $667 Million in Losses for the FDIC

Last year this Substack covered the Silicon Valley Bank debacle, as well as the various other bank “failures…”

PSYOP-MARKET-CRASH: Social Engineering COVID-19 Into The Banking Crisis That Triggers The Global Financial Collapse

This substack had been warning that the PSYOP-19 global depopulation and control program was the setup. The follow-up was always going to be yet another One World Government operation to further consolidate power and usher in the Great Reset. As predicted over two years ago, PSYOP-MARKET-CRASH was one of the more viable post “pandemic” follow-ups for …

…which will be leveraged as a systemic banking “crisis” ahead of the global financial collapse that will usher in the X Everything App social credit score CBDC scheme.

How Technocommunism Will Institute The CBDC: The Central Bank Game Plan In Under 3 Minutes

The entire global financial system is now essentially a technocommunist black ops money laundering crime scene. Central banks, their wall street coconspirators and the major corporations are all colluding in ushering in their hyper-centralized CBDC dystopia. This central bank “currency” will of course be inextricably tethered to the A.I. social credi…

In the meantime, we have the resumption of last year’s banking failures, and the first bank to implode in 2024 being for all intents and purposes taken over by an essentially insolvent and illegitimate “independent” Federal agency:

by Pam Martens and Russ Martens

Quietly on Friday, the FDIC announced the first federally-insured bank failure of 2024, the publicly-traded Republic First Bancorp (ticker FRBK) which did business as Republic Bank. In an unsettling sign of the times, this federally-insured bank was trading at 1-cent on Friday; down from 27-1/2 cents last September when we first reported on its dire condition.

Do Americans really want to see a bank that’s holding their life savings to be trading as a penny stock?

Yes, it’s true that no depositor has lost a penny in a federally-insured bank since the creation of federal deposit insurance in 1933 if they remained under the federal insurance cap on deposits. Currently, that insurance cap is $250,000 per depositor, per bank. But still, public confidence in the safety and soundness of the U.S. banking system would suggest that the phrases penny stock and bank deposit are not a good combination.

The FDIC announced a smooth transition plan for depositors at the failed bank on Friday:

“To protect depositors, the FDIC entered into an agreement with Fulton Bank, National Association of Lancaster, Pennsylvania to assume substantially all of the deposits and purchase substantially all of the assets of Republic Bank.

“Republic Bank’s 32 branches in New Jersey, Pennsylvania and New York will reopen as branches of Fulton Bank on Saturday (for branches with normal Saturday hours) or on Monday during normal business hours. This evening and over the weekend, depositors of Republic Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on Republic Bank will continue to be processed and loan customers should continue to make their payments as usual.”

According to the most recent financial data for the bank that is available to the public at the FDIC, as of December 31, 2023 it had $4.37 billion in deposits, of which $2.253 billion were uninsured, or 52 percent. Uninsured deposits played a key role in the bank runs at Silicon Valley Bank and Signature Bank in March of last year. Both banks failed and resulted in billions of dollars in losses to the FDIC’s Deposit Insurance Fund (DIF).

On Friday, the FDIC announced that it will be taking a $667 million loss on the failure of Republic Bank.

Another teetering bank whose share price has taken a big hit this year is New York Community Bancorp (ticker NYCB), parent of Flagstar Bank. For the recent history of that bank, see our March report: Steve Mnuchin, Trump’s Treasury Secretary/Foreclosure Kingpin, Joins with Hedge Fund Guys to Grab a Teetering, Federally-Insured Bank for $2 a Share.

New York Community Bancorp’s stock has lost over 70 percent of its market value year-to-date. The stock closed Friday at $2.97. Its federally-insured bank, Flagstar, is not a tiny bank that would do minimal damage to the Deposit Insurance Fund if it failed. According to the FDIC, as of December 31, 2023, Flagstar had $116 billion in assets with 420 branches in 12 states.

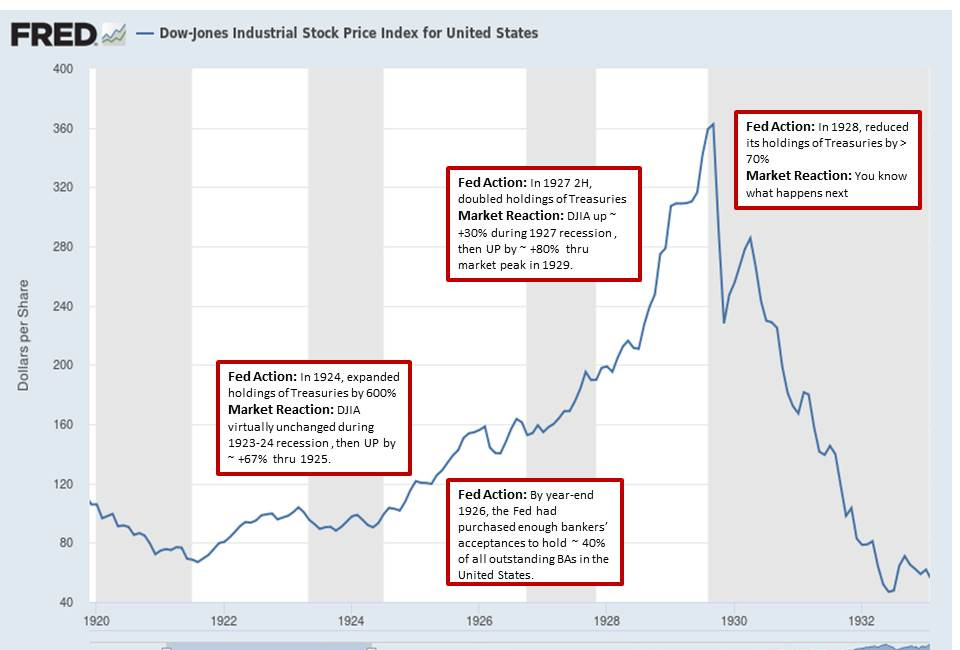

With Wall Street traders’ expectation for banks to receive a Fed put this year (from multiple interest rate cuts by the Fed) now looking doubtful in the face of sticky inflation, it’s pretty clear that last spring’s bank blowups are not the end of this story.

The great irony here is that the FDIC has nowhere near the requisite liquidity to insure all of the bank accounts it alleges to be protecting.

Expect many more bank failures heading into the November election, which will invariably coincide with the various other psyops and false flags planned for We the People.

They want you dead.

Do NOT comply.

I think you have it a bit backwards.

We have been hearing for decades that social security will be broke after the first wave of boomers starts retiring. Which started happening a while ago. IMHO, SS going broke is the first part of "collapse." They knew it was coming, and have known for a very long time.

The Great Reset was a way to capitalize on this collapse and make it work for those in charge. So they implemented c0vid and the death jabs for depop. And don't forget "wars" to fill up the coffers of politicos and their friends in Big Mil. Plus... more depopt. And... rampant government spending. Because they never intend on paying it back. Next up? CBDCs. And so on.

"When life gives you lemons, make lemonade."

Don't let them make lemonade. The very least each one of us can do is use cash at every opportunity, as well as checks. Don't. Feed. The. Beast.

Banks failing in the most corrupt U.S. states of Pennsylvania and New York.